FHLBank Chicago Announces Q1 2024 Financial Highlights

Commits over $110 million to affordable housing and community development for 2024

The Federal Home Loan Bank of Chicago (FHLBank Chicago) today announced its preliminary and unaudited financial results for the first quarter of 2024. As of the first quarter, FHLBank Chicago has committed over $110 million to affordable housing and community development initiatives for 2024.

“Coming off of the market events during the past year, FHLBank Chicago reached new heights in supporting our member financial institutions and the communities they serve,” said Michael Ericson, president and chief executive officer of FHLBank Chicago. “In 2024, we continue to focus on reinvesting back into our district by serving as a reliable source of funding and liquidity to our members and taking action in response to real housing and community needs.”

First Quarter 2024 Financial Highlights

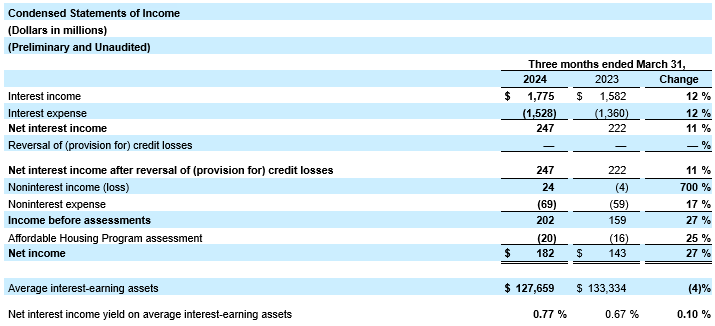

- Net income was $182 million, compared to $143 million for the first quarter of 2023, driven by increased returns on our investments and advances portfolio due to higher interest rates, and an increase in noninterest income which was primarily driven by gains from derivatives used to hedge our market risk exposure.

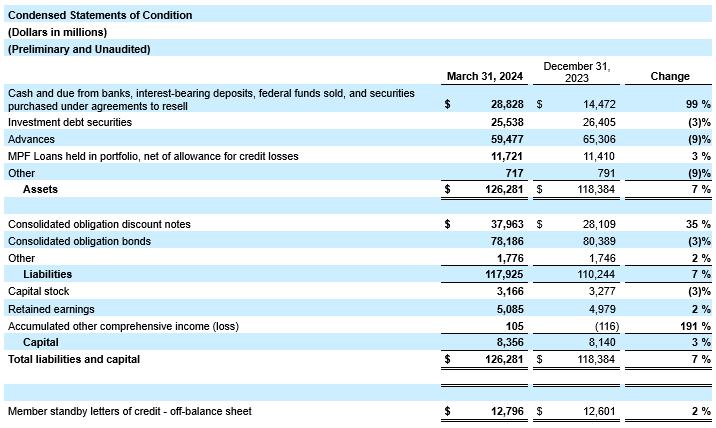

- Total assets increased to $126.3 billion, compared to $118.4 billion at December 31, 2023, with the change primarily attributable to an increase in our liquidity portfolio.

- Advances outstanding decreased to $59.5 billion, compared to $65.3 billion at December 31, 2023, primarily attributable to depository members experiencing less funding needs on their balance sheets along with reduced loan demand which resulted in paydowns.

- Mortgage loans held for portfolio through the Mortgage Partnership Finance® Program increased to $11.7 billion, compared to $11.4 billion at December 31, 2023, primarily attributable to new acquisition volume that outpaced paydown and maturity activity.

- As of March 31, 2024, FHLBank Chicago was in compliance with all regulatory capital requirements.

“As we continue into 2024, FHLBank Chicago remains committed to using our financial strength to support our members and their communities through affordable housing and community investment initiatives,” said Ericson. “We look forward to continuing to deliver value and adapt our efforts in response to the needs of our members and district.”

Ongoing Commitment to Housing and Community Development

FHLBank Chicago has allocated nearly $49 million toward its annual Affordable Housing Program (AHP) General Fund and the competitive round will be open May 6 through June 14, 2024. Additionally, the maximum per-project subsidy has doubled to $2 million in 2024 to increase financial impact for future affordable housing projects and developments.

FHLBank Chicago opened its year-round Downpayment Plus® (DPP®) grant program in January of this year with a budget of $39 million for 2024 and a new per member limit of $1 million annually, representing a nearly 43% increase over the 2023 limit of $700,000. These programs allow participating members to help their low income-eligible borrowers with down payment and closing costs of up to $10,000.

Three Community First® grant programs enter their third year in 2024 after being created in response to critical needs of members and communities across Illinois and Wisconsin—the Diverse Developer Initiative, Housing Counseling Resource Program and Accelerate Grants for Small Business. FHLBank Chicago has committed more than $25 million to these programs in 2024 to target affordable housing development, access to financial education and funding for small businesses.

Additionally, FHLBank Chicago offers Community Advances at below market rates to help members fund affordable housing and economic development needs in their communities, and more than $237 million was funded in first quarter 2024.

For more financial details, please refer to the Condensed Statements of Income and Statements of Condition below. The Form 10-Q for the quarter ending March 31, 2024, is expected to be filed with the Securities and Exchange Commission (SEC) next month.

About the Federal Home Loan Bank of Chicago

FHLBank Chicago is a regional bank in the Federal Home Loan Bank System. FHLBanks are government-sponsored enterprises created by Congress to ensure access to low-cost funding for their member financial institutions, with a focus on providing solutions that support the housing and community development needs of members’ customers. FHLBank Chicago is a self-capitalizing cooperative, owned by its Illinois and Wisconsin members, including commercial banks, credit unions, insurance companies, savings institutions and community development financial institutions. To learn more about FHLBank Chicago, please visit fhlbc.com.

“Community First”, “Downpayment Plus Program”, “DPP”, “Mortgage Partnership Finance”, and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.