LIBOR Financing Alternative

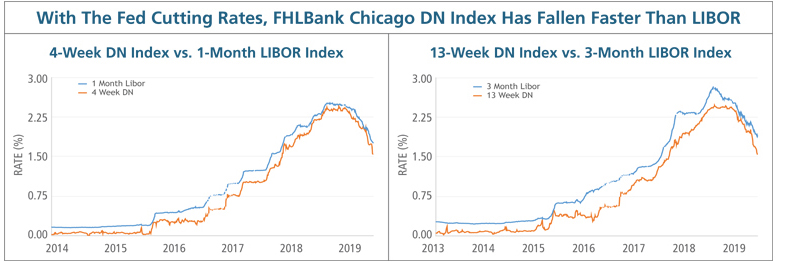

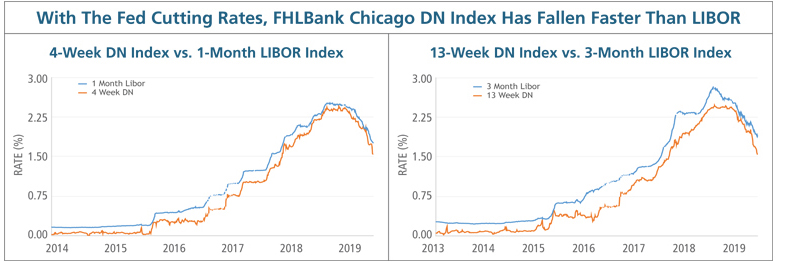

As the market transitions away from the London Interbank Offered Rate (LIBOR), a Discount Note (DN) advance could be an attractive alternative for floating rate funding.

Discount Note Market - Quick Facts:

Discount Note Market - Quick Facts:

- Discount Notes are short term (less than 1 year) debt securities that have been issued by the FHLBanks since 1975 and are purchased by a global institutional investor base.

- Total DN issuance in 2018 was $2.38 trillion and YTD (through 10/31/19) was $1.78 trillion.

- DN Index is 99% correlated historically to comparable LIBOR Index.

- FHLBanks are the second largest issuer in the public debt market behind the U.S. Treasury.

Benefits of DN Floater Advances:

- DN Floater advances have historically been lower cost than comparable LIBOR advances due to the FHLBanks’ strong credit ratings (Aaa/AA+).1

- Flexible rate reset dates that can be customized to your ALM needs.

- Ability to embed prepayment feature on reset dates.

- Weekly DN auction results available on the FHLBank Office of Finance website and DN Index history on Bloomberg. Daily quotes for DN Floater advances available at fhlbc.com.

Getting Started

1. Choose Your Term: Overnight to 10 years, depending on the advance type.

2. Choose Interest Rate Reset Frequency: Overnight; 4-, 13-, or 26- weeks. Spread is locked at time of advance.

3. Execute Advance: Contact your Sales Director or call the Member Transaction Desk at (855) 345-2244.

1. Choose Your Term: Overnight to 10 years, depending on the advance type.

2. Choose Interest Rate Reset Frequency: Overnight; 4-, 13-, or 26- weeks. Spread is locked at time of advance.

3. Execute Advance: Contact your Sales Director or call the Member Transaction Desk at (855) 345-2244.