FHLBank System Regulator Provides LIBOR Transition Guidance

NOTE: This announcement is superseded by our March 19, 2020 LIBOR Transition Guidance.

The financial markets are preparing for the expected phase-out of the London Interbank Offered Rate (LIBOR) by the end of 2021.

As part of this transition, the Federal Housing Finance Agency (FHFA) recently issued a supervisory letter to all Federal Home Loan Banks (FHLBanks). The FHFA, which regulates the FHLBanks, has required that by March 31, 2020, the FHLBanks cease entering into new LIBOR referenced instruments with maturities beyond December 31, 2021.

This change will impact certain FHLBank Chicago products with a LIBOR component made after March 31, 2020, and maturing after December 31, 2021. In the coming months we will be reaching out with additional information on how these changes may affect collateral reporting as well.

What’s Changing:

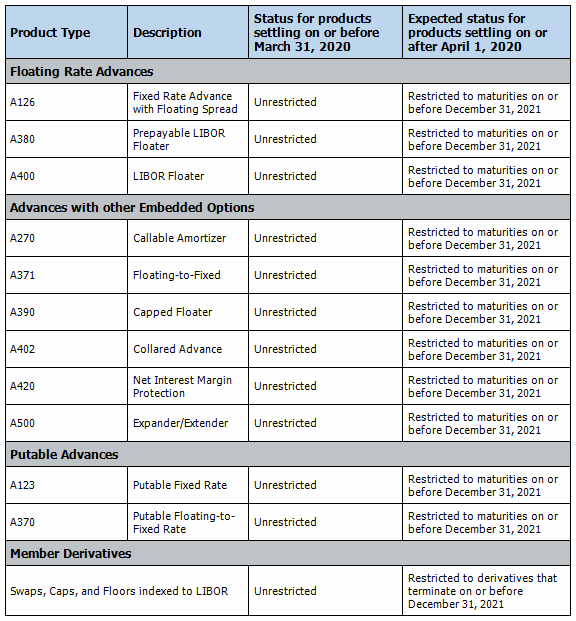

• From now until March 31, 2020, members can continue to execute the advance products with a LIBOR component listed below with no tenor restrictions as long as the transactions settle by March 31, 2020.

• Beginning April 1, 2020, members can still transact the below advance products with a LIBOR component as long as they mature by December 31, 2021.

• Beginning April 1, 2020, transactions with maturities settling beyond December 31, 2021, are expected to be suspended.

FHLBank Chicago Products with a LIBOR Component:

If you are looking to replace these products, Discount Note-indexed floaters, Prime-indexed floaters, and SOFR-indexed floaters are good alternatives to LIBOR floaters and are not subject to these maturity restrictions. Visit fhlbc.com/products/advances for a complete list of our advance product offerings.

The FHFA has also directed the FHLBanks to update their pledged collateral certification reporting requirements by March 31, 2020 in an effort to encourage members to distinguish LIBOR-linked collateral maturing past December 31, 2021.

The full letter from the FHFA is available for your reference at https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/Supervisory-Letter_Planning-for-LIBOR-Phase-Out.pdf.

The 11 FHLBanks are participating in industry-wide efforts to facilitate an orderly transition to an alternative reference rate. Each FHLBank has developed a multi-year plan to reduce its LIBOR exposures over time.

As we prepare for this transition, we also want to ensure that you, our members, are as prepared as possible. Resources regarding the LIBOR transition are available on our website: fhlbc.com/solutions/libor-transition.

We will provide you with ongoing updates as new information and resources become available. If you have questions regarding this communication or would like more details on the LIBOR transition, please contact your Sales Director at membership@fhlbc.com.

The financial markets are preparing for the expected phase-out of the London Interbank Offered Rate (LIBOR) by the end of 2021.

As part of this transition, the Federal Housing Finance Agency (FHFA) recently issued a supervisory letter to all Federal Home Loan Banks (FHLBanks). The FHFA, which regulates the FHLBanks, has required that by March 31, 2020, the FHLBanks cease entering into new LIBOR referenced instruments with maturities beyond December 31, 2021.

This change will impact certain FHLBank Chicago products with a LIBOR component made after March 31, 2020, and maturing after December 31, 2021. In the coming months we will be reaching out with additional information on how these changes may affect collateral reporting as well.

What’s Changing:

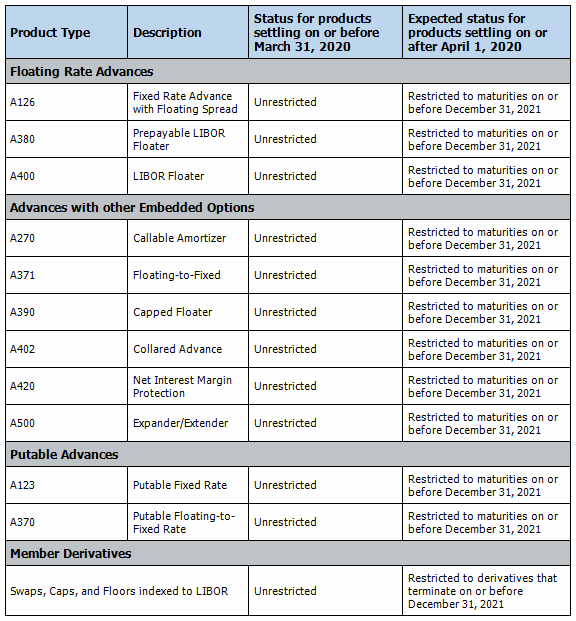

• From now until March 31, 2020, members can continue to execute the advance products with a LIBOR component listed below with no tenor restrictions as long as the transactions settle by March 31, 2020.

• Beginning April 1, 2020, members can still transact the below advance products with a LIBOR component as long as they mature by December 31, 2021.

• Beginning April 1, 2020, transactions with maturities settling beyond December 31, 2021, are expected to be suspended.

FHLBank Chicago Products with a LIBOR Component:

The FHFA has also directed the FHLBanks to update their pledged collateral certification reporting requirements by March 31, 2020 in an effort to encourage members to distinguish LIBOR-linked collateral maturing past December 31, 2021.

The full letter from the FHFA is available for your reference at https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/Supervisory-Letter_Planning-for-LIBOR-Phase-Out.pdf.

The 11 FHLBanks are participating in industry-wide efforts to facilitate an orderly transition to an alternative reference rate. Each FHLBank has developed a multi-year plan to reduce its LIBOR exposures over time.

As we prepare for this transition, we also want to ensure that you, our members, are as prepared as possible. Resources regarding the LIBOR transition are available on our website: fhlbc.com/solutions/libor-transition.

We will provide you with ongoing updates as new information and resources become available. If you have questions regarding this communication or would like more details on the LIBOR transition, please contact your Sales Director at membership@fhlbc.com.