Secondary Mortgage Solutions for Today’s Challenging Market

February 22, 2024

Overview

FHLBank Chicago supports members in every mortgage market environment through its Mortgage Partnership Finance® (MPF®) Traditional and Downpayment Plus® (DPP®) programs. MPF Traditional offers participating financial institutions (PFIs) a secondary market outlet with competitive pricing on residential mortgage loans. PFIs can take advantage through low loan balance price payups, longer seasoning requirements, and no loan level price adjustments. PFIs also earn income over the life of their loans in the form of CE (credit enhancement) income, for sharing credit risk with FHLBank Chicago, helping smooth profitability over various market environments. The DPP programs offer down payment assistance to members’ qualifying borrowers in the form of grants, supporting housing affordability in their communities. The 2024 round of DPP opened on January 16, 2024.

Key Takeaways

- The mortgage market will likely stay challenging due to inventory constraints, lack of affordability, and low refinancing incentive for borrowers.

- MPF Traditional offers higher secondary market profitability to participating financial institutions.

- Take advantage of better liquidity for seasoned loans to free up balance sheet capacity.

- Low loan balance pay ups and down payment assistance from FHLBank Chicago can help you support affordable housing in your communities.

- Request a custom pricing comparison to view your all-in benefits of participating in MPF versus other correspondents.

Mortgage Market Trends

The rally across financial assets in the fourth quarter of 2023 has pushed mortgage rates to the lowest level since June 2023. At the December Federal Open Market Committee (FOMC) meeting, the Federal Reserve (Fed) left federal funds rates unchanged and released a revised dot plot that pointed to a median of three 25 basis point (bps) cuts in 2024. Markets are now trying to determine the pace of rate cuts moving forward and its implications on the mortgage market. Market expectations are for mortgage rates to gradually ease throughout 2024 but remain elevated compared to 2020 and 2021 levels. Fannie Mae and the Mortgage Bankers Association (MBA) are forecasting that the average 30-year fixed mortgage rate will fall to 5.8% and 6.1%, respectively, in the fourth quarter of 2024.

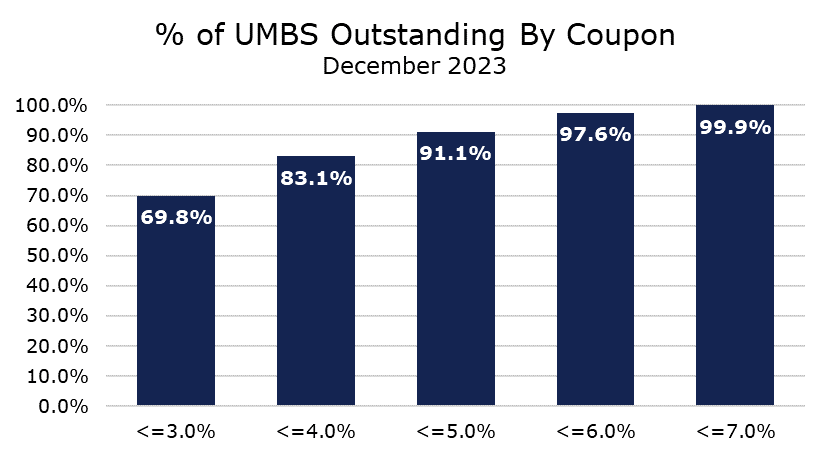

Even a modest decline in the 30-year fixed mortgage rate should support the housing market in 2024. Lower rates could lead to increased origination volume, result in a slight pickup in refinance activity, and alleviate pervasive affordability issues stemming from high interest rates and rising home prices. However, many homeowners have rates well below 6%, see chart 1, dampening the incentive for existing homeowners to move or refinance. As a result, the 2024 mortgage market will likely resemble 2023 in many ways: a lack of inventory, limited existing home sales, ongoing growth in home prices, and low refinance activity. See below for ways FHLBank Chicago’s products can help your institution remain competitive and profitable in 2024.

Chart 1: UMBS Outstanding By Coupon:

UMBS, Uniform Mortgage Backed Securities, are passthrough securities representing an undivided interest in a pool of residential mortgages guaranteed by Fannie Mae or Freddie Mac.

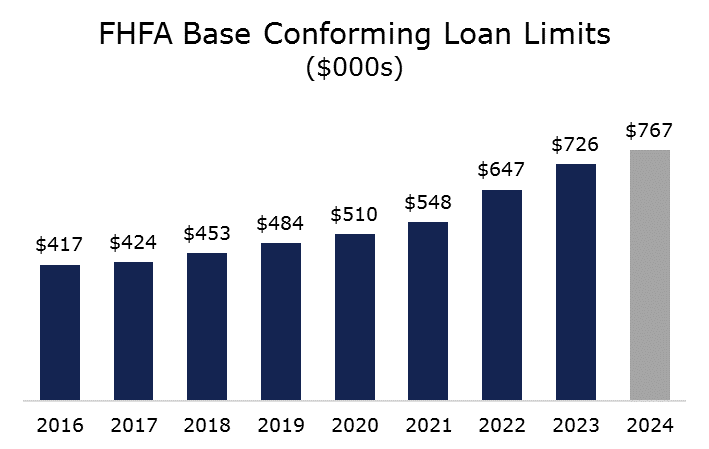

Higher Conforming Loan Limits for 2024

On November 28, 2023, the Federal Housing Finance Agency (FHFA) announced new conforming loan limits (CLL) effective January 1, 2024. The new baseline max conforming loan limit is set to $766,550, an increase of $40,350 year-over-year. The baseline CLL reflects the annual change in the average U.S. home price. Due to rapid home price appreciation in recent years, the conforming loan limit has increased by roughly $218,000 in the last three years.

Members selling mortgages to FHLBank Chicago through an MPF Traditional product with servicing retained have the benefit of longer seasoning requirements compared to other secondary market outlets. Mortgage loans with 24 or fewer monthly payments applied (roughly up to two years seasoned on the funding date) may be sold to MPF Traditional under a regular delivery commitment. This compares to outlets such as Fannie Mae and Freddie Mac, due to securitization into uniform mortgage-backed securities (UMBS), who have a six-month seasoning requirement. If members are interested in selling mortgages with greater than 24 months of seasoning, you can reach out to your Sales Director for a custom quote.

PFIs may take advantage of this benefit and create additional balance sheet capacity in 2024 by selling loans currently held on balance sheet, with a first payment date in 2022 or later, to FHLBank Chicago. There may be an opportunity for loans previously considered high balance, those above the conforming loan limit at the time ($647,200 or $726,200), to now be sold as conforming. For example, you may have a loan on your balance sheet that was originated in September 2022 at $745,000. Until now, this loan was above the CLL and would have to be sold as a high balance or jumbo loan, which typically trades at a pay back from conforming loans. You can now sell this loan as conforming, receiving a higher upfront price. Below illustrates the price difference between a conforming and high balance loan in MPF Traditional but may also be representative of the price difference of a jumbo mortgage sold to another correspondent.

| Potential Value | |

|---|---|

| Conforming Price | 101.1431 |

| High Balance Price | 100.0963 |

| Price Improvement (bps) | 104.7 |

| Pricing date Feb, 13, 2024, FX30, A/A, 6.875%, 15-Day Delivery | |

Value for Affordable Housing Options

MPF Traditional also offers various value-add products and programs to members originating loans at or below the conforming loan limit. Popular affordability options in mortgage origination are eligible to be sold to FHLBank Chicago. For example, temporary buydowns may be an attractive option to offer to potential homebuyers to combat high mortgage rates in the near term, as loans with this feature are eligible to be sold through MPF Traditional.

Many potential homebuyers with lower incomes may find it difficult to secure home financing options in the current market environment. To better support these homebuyers, FHLBank Chicago offers various low loan balance payups on both conventional and government loans up to $275K. Low loan balance grids offer a higher upfront gain on sale to sellers versus higher balance loans, so that PFIs may be able to pass along the pricing benefits to their borrowers. FHLBank Chicago introduced a new $275K max grid available on conventional 30-year loans in September 2023.

Another way for PFIs to stay competitive and help improve housing affordability is to pair the MPF program with FHLBank Chicago’s DPP programs. Homebuyers with incomes at or below 80% of area median income may be eligible to receive a forgivable grant through your member institution. Members can offer grants up to $10,000 in size to their borrowers to assist with down payment and closing costs. The member would later be reimbursed by FHLBank Chicago post-closing. Reservations are available on a first-come, first-serve basis with each member able to offer up to $700,000 in grants in 2024. In 2023, over $33M was disbursed in DPP grants to more than 3,500 households. The 2024 DPP round opened on January 16, 2024. Using DPP with the MPF program can help PFIs attract new customers, lower the loan-to-value ratio of the originated loan, and free up balance sheet capacity. You can view more information about our DPP program and get access to marketing materials on fhlbc.com.

Comparing the All-In Value of MPF Traditional

FHLBank Chicago offers customized price comparisons for members illustrating the all-in benefit of MPF Traditional versus other correspondents. A custom price comparison includes the expected value members can earn from no loan level price adjustments plus credit enhancement income and dividend income paid to members for sharing in the credit risk. If a loss occurs, the credit risk sharing feature of MPF Traditional allocates those losses after borrower equity and private mortgage insurance through a loss structure dependent on your specific product. Contact your Sales Director today for more information or for a custom price comparison.

| Pricing Comparison* | ||

|---|---|---|

| MPF Traditional | Correspondent | |

| Base Price | 100.802 | 100.132 |

| 150K Max Payup | 2.199 | 2.514 |

| LLPA | - | (1.250) |

| Net Present Value of CE Income (assumes 10 bps annualized) | 0.500 | - |

| Net Present Value of Dividend Benefit** | 0.450 | - |

| All-In Price | 103.951 | 101.397 |

*For illustration purposes only. CE Income does not assume any losses or costs of allocating capital. Indicative pricing as of January 8, 2024. Estimates based on the following loan attributes: 30-year, A/A, 6.75%, 15-day mandatory delivery, owner-occupied, single-family, 720 FICO, 85% LTV purchase loan with 5-year average life.

**Reflects B1 activity stock dividend as an enhancement to the MPF Traditional average return, based on a dividend rate of 8% for Q2 2023, the present value of the dividend income over five years discounted by an opportunity cost of buying stock equal to the 5-Year Treasury Yield, and 2.00% capitalization, for illustration purposes only. On October 24, 2023 FHLBank Chicago announced forward guidance in which we expect to maintain an 8.25% dividend for B1 activity stock for Q1 and Q22024. Any future dividend payments remain subject to determination and declaration by our Board of Directors, and may be impacted by changes in financial or economic conditions, regulatory and statutory limitations, and any other relevant factors.

Download the PDF of this white paper.

Contributors

| Jessica Nick AVP, Lead Analyst Sales, Strategy, and Solutions | |

| Emma Dublin Strategy and Solutions Associate Sales, Strategy, and Solutions | |

| Ashish Tripathy SVP, Managing Director, Member Strategy and Solutions Sales, Strategy, and Solutions |

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis.

The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute

legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other

advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included,

and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based

upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s

periodic filings with the Securities and Exchange Commission, which are available on its website.