Shorten Your Delivery Commitments to Maximize Your Income

June 30, 2021

Shorten Your Delivery Commitments to Maximize Your Income

Participating Financial Institutions (PFIs) have a trifecta of layers of opportunity today when selling conventional/conforming loans to the Federal Home Loan Bank of Chicago (FHLBank Chicago) through our Mortgage Partnership Finance® (MPF®) Traditional products (MPF Original, MPF 125, and MPF 35):

- Maximize your profit at the time of sale through competitive up-front prices and no loan level price adjustments.

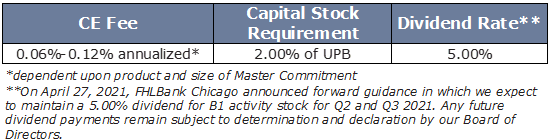

- After the initial sale, PFIs earn credit enhancement (CE) fee income for sharing in part of the credit risk with FHLBank Chicago. This CE fee income continues throughout the life of the loan, as long as it remains on FHLBank Chicago’s balance sheet.

- Beginning May 3, 2021, all new master commitments (MC) will require capital stock of 2% of the funded UPB. FHLBank Chicago currently pays a 5% dividend** on this capital stock, which allows PFIs to earn additional dividend income over the life of the loans they sell to FHLBank Chicago. View our new capital stock requirements here.

Are Your Operations Efficient Enough to Close Sooner and Earn a Higher Price Today?

By shortening the lock period on your delivery commitment (DC), you can increase the base price of the loan sold into MPF Traditional.To lock-in interest rates and protect themselves and their borrowers from market fluctuations that may occur between application and closing, PFIs take out rate locks (delivery commitments) to sell a loan at a particular rate within a certain period of time—typically 30 to 60 days. MPF Traditional settlement dates are 5-day, 15-day, 30-day, 45-day, and 60-day and are flexible enough to allow the PFI to substitute a different loan, or loans, and/or different note rates (with flexibility +/- .25% of the DC note rate) to make up for any fallout. Thus, PFIs can mix and match loans as needed to meet their DCs within the specified commitment term. Because of this, PFIs should consider shortening their DCs settlement dates as much as possible, in order to earn a better up-front price.

In the below example, a PFI can pick up an additional 32.4 basis points (bps) by shortening the commitment term from 60 days to 15 days on a 3.000% gross note rate, 30-year loan. This may require more effort by the PFI to manage fallout risk but also provides greater reward, especially for the organization able to effectively manage its operations to meet these shorter commitment terms.

Maximize Income in Future Mortgage Origination Environments

The housing market is expected to continue to thrive in 2021, as mortgage rates remain historically low, making both refinances and purchases attractive options to your borrowers. Loans originated at very low rates may stick around longer, however, making it important to consider today your options to generate income in the future. By selling your lower rate refinance loans to MPF Traditional, PFIs lock in two additional future income streams: CE fee income and dividend income. These additional income sources are paid over the life of your loans, helping you keep up your income throughout different economic environments.