Take Advantage of Bear Steepening

While short-term benchmark rates continue to hover just above zero, intermediate and long-term rates have risen. This phenomenon, known as a bear steepener, could be a result of higher inflation expectations. The Federal Home Loan Bank of Chicago’s (FHLBank Chicago) symmetrical prepay feature allows members to monetize a gain on longer fixed-term advances in a steepening scenario. For an additional 2 basis points added to the advance rate, members can protect against inflation driving long-term rates higher. Additionally, we are currently offering a 5 basis point discount special on qualifying fixed and amortizing advances.

Curve Steepening

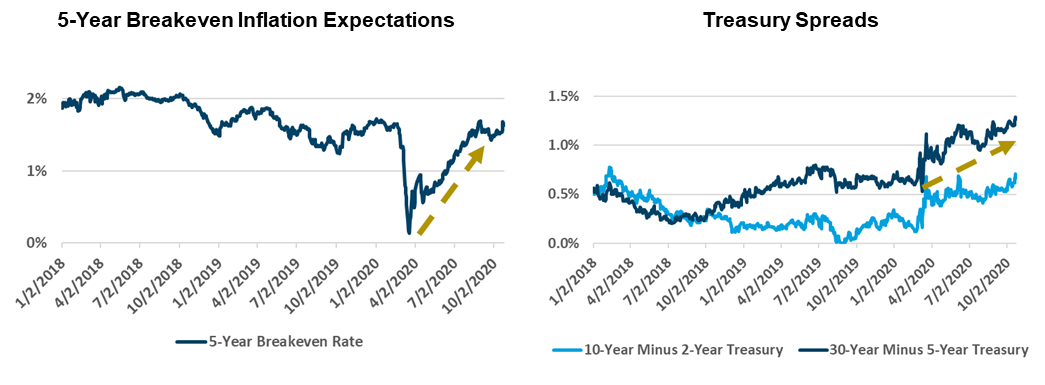

At the onset of the current COVID-19 crisis, the CARES Act combined with unprecedented Fed asset purchases caused real interest rates to plummet. However, the potential for further fiscal stimulus along with continued deficit spending and easy monetary policy from the Fed has revived inflation expectations.

As the Fed signals low short-term rates for the extended future, rates at the longer end of the curve have begun to rise, causing the curve to steepen.

Monetizing Rising Rates with Symmetrical Prepay

FHLBank Chicago offers an optional symmetrical prepay feature to advances for a 2 basis point addition onto the regular rate. The feature allows members to prepay an advance at a discount if interest rates rise above the advance rate. This would constitute a gain on the liability side of the balance sheet.

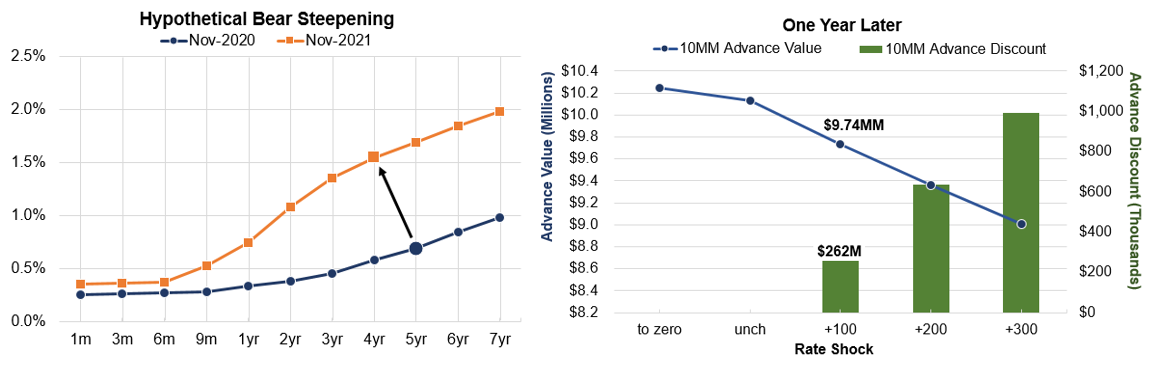

For example, let’s assume a member executes a 5-year fixed symmetrical advance for $10 million. The regular rate is 0.69% but increases to 0.71% with the added symmetrical feature. Assume that one year later, interest rates on the 4-5 year part of the curve rose 100 basis points. The original 5-year advance now has 4 years remaining to maturity. The hypothetical 4-year advance would be near 1.58% at this future point in time. The member’s $10 million fixed-rate advance at 0.71% would be at a market discount. Therefore, the member could, if they chose, prepay the $10 million principal back for approximately $9.74 million. They could capture a discount of about $262,000 as a gain to income through the symmetrical feature. The discount could be even larger if interest rates rose higher. See the figures below to illustrate:

FHLBank Chicago Discount Special

We further encourage our members to take advantage of longer-term funding by receiving/taking an additional 5 basis point discount special on qualifying fixed-term and amortizing advances. The special applies to:

- Ladder of three or more fixed advances

- Single amortizing advance

- Single fixed-rate advance

You can see the full terms and conditions of the special expiring on December 31, 2020 here.

Questions?

Please reach out to your Sales Director with any questions.