Notes from the Funding Desk: Flexible and Affordable Funding

Take advantage of your Federal Home Loan Bank of Chicago (FHLBank Chicago) membership to satisfy your liquidity needs in these uncertain times. We offer flexible funding through our fixed callable advances, giving you the right to terminate an advance early without a prepayment fee, after a specified lock-out period. You can keep the advance to maturity at your benefit if rates rise, or call it for any reason to your benefit if rates fall. Callable advances may be used to match fund callable assets such as Paycheck Protection Plan (PPP) loans (1% yield), mortgage backed securities (Fannie 2.5% 30Y at 1.56% yield), or municipal bonds (0.7-1.4% TEY) to lock in income. Lock in flexible funding below 1% and benefit as interest rates move, especially in these volatile times.

Benefits in Rates Up

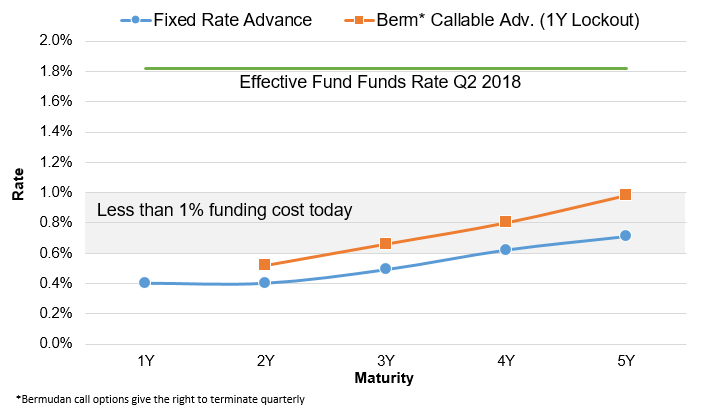

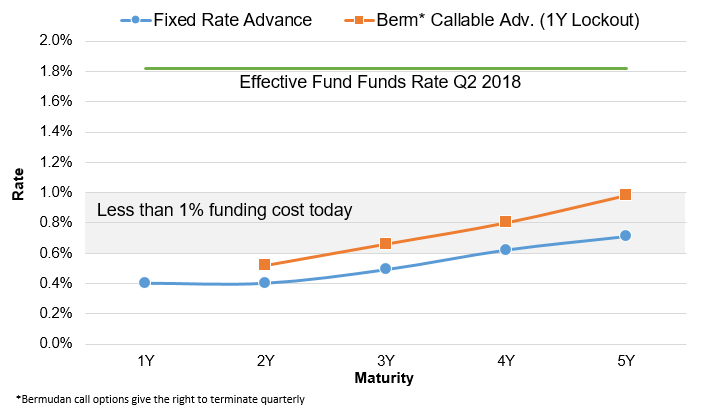

At a time when the Effective Federal Funds rate was 1.82%, FHLBank Chicago members paid an average 1.79% on borrowings in Q2 2018. While much has changed over the last two years, it’s not unreasonable to believe we could reach those rates again. Locking in fixed rate funding today will allow your institution to benefit if rates move higher in the future.

Flexibility if Rates Fall

The Effective Federal Funds rate is nearly zero today at 0.05%. While the Federal Open Market Committee (FOMC) has shown disdain for negative interest policy, markets believed otherwise. The 30-day fed funds futures contract for January 2021 yielded -0.015% on May 7 this year. It has since rebounded to positive territory. However, negative interest rates are only a new phenomenon in the United States. The European Central Bank (ECB) deposit facility rate first went to -0.10% in June 2014 and is -0.50% today. The Bank of Japan’s overnight lending rate has been -0.10% since March 2016.

FHLBank Chicago’s callable advances gives your institution the flexibility to potentially take advantage of lower or even negative rates in the future with the ability to terminate and pay back at par. These advances provide flexibility when borrowers refinance or prepay debt held on your institution’s balance sheet, which typically occurs in lower rate environments.

FHLBank Chicago Is Strong and Here for You

FHLBank Chicago is ready to serve our members through these difficult times. We announced a 5% activity stock dividend for Q1 2020 and issued guidance that this rate will continue through Q2. We hope to give our member’s peace of mind in their investment in us, having grown our retained earnings to $3.8 billion as of March 31, 2020. Trust FHLBank Chicago to help your institution now and in the future.

Callable advances must be executed with a balance of $5 million or greater. The borrower must notify FHLBank Chicago in writing five business days prior to termination date to call the advance. The advance proceeds may be called in whole or in part.

Please reach out to your Sales Director to learn more about our callable advances.

Benefits in Rates Up

At a time when the Effective Federal Funds rate was 1.82%, FHLBank Chicago members paid an average 1.79% on borrowings in Q2 2018. While much has changed over the last two years, it’s not unreasonable to believe we could reach those rates again. Locking in fixed rate funding today will allow your institution to benefit if rates move higher in the future.

Flexibility if Rates Fall

The Effective Federal Funds rate is nearly zero today at 0.05%. While the Federal Open Market Committee (FOMC) has shown disdain for negative interest policy, markets believed otherwise. The 30-day fed funds futures contract for January 2021 yielded -0.015% on May 7 this year. It has since rebounded to positive territory. However, negative interest rates are only a new phenomenon in the United States. The European Central Bank (ECB) deposit facility rate first went to -0.10% in June 2014 and is -0.50% today. The Bank of Japan’s overnight lending rate has been -0.10% since March 2016.

FHLBank Chicago’s callable advances gives your institution the flexibility to potentially take advantage of lower or even negative rates in the future with the ability to terminate and pay back at par. These advances provide flexibility when borrowers refinance or prepay debt held on your institution’s balance sheet, which typically occurs in lower rate environments.

FHLBank Chicago Is Strong and Here for You

FHLBank Chicago is ready to serve our members through these difficult times. We announced a 5% activity stock dividend for Q1 2020 and issued guidance that this rate will continue through Q2. We hope to give our member’s peace of mind in their investment in us, having grown our retained earnings to $3.8 billion as of March 31, 2020. Trust FHLBank Chicago to help your institution now and in the future.

Callable advances must be executed with a balance of $5 million or greater. The borrower must notify FHLBank Chicago in writing five business days prior to termination date to call the advance. The advance proceeds may be called in whole or in part.

Please reach out to your Sales Director to learn more about our callable advances.