Leveraging Municipal Bonds in the COVID-19 Crisis

Overview

The COVID-19 outbreak continues to stress financial markets around the world. As uncertainty remains high, investment opportunities in loans may dry up. Financial institutions should consider Bonds may present an alternative means to boost net interest income (NII), net interest margin (NIM), and return on risk-weighted assets.

In volatile conditions like these, financial institutions should be on the lookout for timely investment strategies, such as purchasing now-higher-yielding municipal bonds while hedging the interest-rate risk with funding from FHLBank Chicago. The 7-year AAA tax-exempt municipal bond index reached a 9-year peak nominal yield of 2.73% on March 23, 2020. This equates to a tax-equivalent yield (TEY) of 3.45% for C corporations taxed at 21%. Tax-exempt general obligation municipal bonds are backed by the full taxing authority of local governments. While yields have fallen from their peak on March 23, they are still attractive today. Credit risk is a consideration in this sector. However, historically, default rates are very low for investment-grade debt; municipal bond defaults averaged 0.18% from 1970 to 2016.

Pairing Bonds With Advances

FHLBank Chicago can provide attractive funding to purchase municipal bonds, and offers a unique way to hedge the interest-rate risk associated with them. The bonds’ cash flows are structured similarly to those of fixed rate advances. Matching the maturity dates of a fixed term advance and a municipal bond allows members to lock the income spread between the two. There is no prepayment risk associated with this sector due to a feature known as defeasance, which requires municipal borrowers to replace the cash flows of their current debt with treasury bonds if they decide to prepay—thus ensuring that investors receive their expected cash flow through the maturity date.

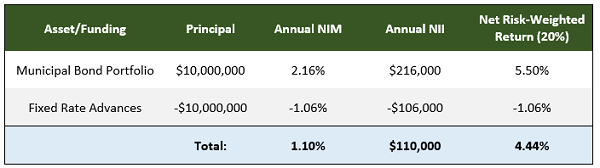

As shown in Table 1 below, FHLBank Chicago members could earn an average TEY of 2.16%, assuming a 21% tax rate, by supporting local municipalities through tax-exempt bond purchases. The premium would be amortized over the life of the bonds.

Table 1: Municipal Bond Portfolio Example

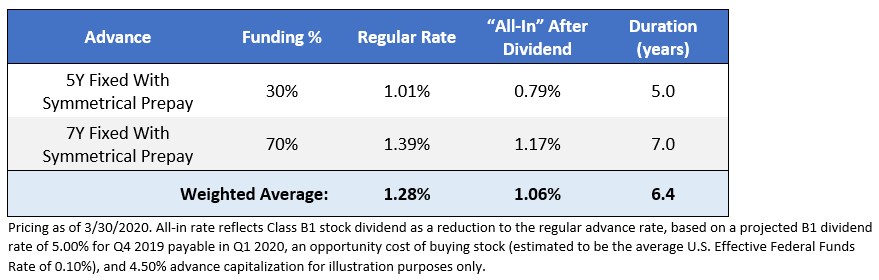

Members would pay a weighted average rate of 1.28%, or 1.06% net of the dividend benefit, for a mix of fixed rate advances closely matching the municipal bond portfolio. Table 2 shows the breakdown of executing fixed advances with the symmetrical prepayment option. This feature allows the member to capture a discount on the advance if market rates rise after execution. It can be utilized to offset market value losses on the municipal bond portfolio as rates rise. The advance rate is increased by 2 basis points for this feature.

Table 2: Fixed Rate Advance Funding Example

This strategy would produce a 1.10%, or $110,000 per year with a $10 million portfolio. Municipal bonds have a risk weighting of 20%. Therefore, the net return on risk-weighted assets is 4.44%. See Table 3 for the NII, NIM, and risk-weighted return projections.

Table 3: NII and NIM for Leverage Strategy Example

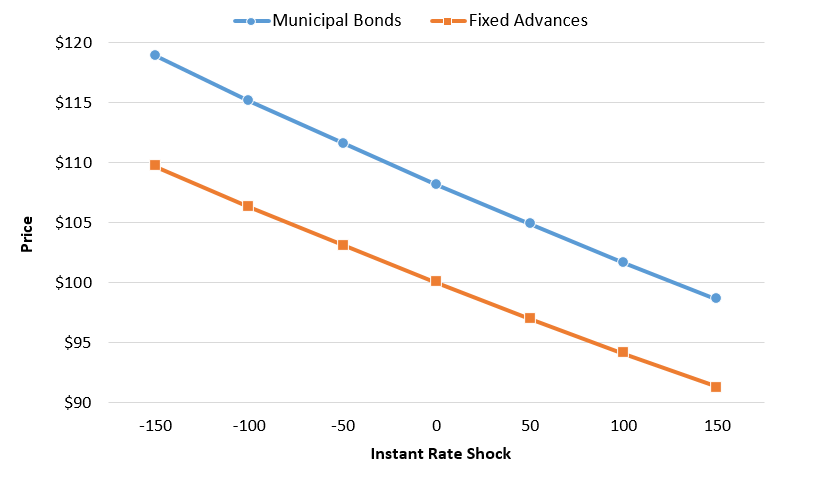

The strategy protects against market value depreciation if interest rates rise. The unrealized loss of owning an asset at a below-market yield is offset by owning a liability at a lower rate. As shown in Figure 1, both the municipal bonds and the advance funding have the same interest rate sensitivity. Falling prices on the fixed advances would represent a discount to the borrower, and would offset losses from the municipal bonds. Members can take advantage of that discount through the symmetrical prepayment option, and prepay the advances at less than par.

Figure 1: Interest Rate Shock Scenarios

While municipal bonds are used in this leverage strategy, a variety of other investments could be used. Options include mortgage-backed securities (MBS), collateralized mortgage obligations (CMOs), commercial MBS, or Small Business Administration, corporate, or other bonds. Members can also use many different advance structures, with or without embedded options, to meet their needs.

To Learn More

If your institution would like more specific information about these strategies, please feel free to reach out to the Solutions team or your Sales Director at membership@fhlbc.com.

Contributors

Nick Simoncelli

Senior Analyst, Sales, Strategy, and Solutions

Disclaimer

The risks of using leverage strategies should be reviewed by each financial institution to ensure they do not breach any regulatory requirements and understand the characteristics of any investments and borrowings they are making before engaging in such a strategy. The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago April 2020