Leaving LIBOR: Plan Now for a Smooth Transition: Q1 2020

Background and Current State of the Transition

The impending phase-out of the London Interbank Offered Rate (LIBOR) by December 31, 2021, has become a key issue facing financial markets, as it is one of the most widely used reference rates, with nearly $200 trillion of derivatives, loans, and securities referencing USD LIBOR (according to the Second Report of the ARRC). Given the considerable volume of contracts tied to LIBOR, a smooth transition to a new reference rate is crucial for the stability of financial markets.After 2021, these derivatives, loans, and securities will reference a new rate, largely agreed to be the Secured Overnight Financing Rate, or SOFR, which the ARRC selected in 2017 to replace LIBOR. As a result, the New York Fed began publishing

SOFR in May 2018, and market volume has continued to build since. However, the transition has been slow and complex thus far, as the industry has only begun to develop and implement transition plans.

Three areas of focus have emerged in the transition to date: first, defining fallback language to incorporate into new contracts that may still reference LIBOR today, and subsequently addressing legacy contracts that reference LIBOR; second, developing a SOFR cash market including bonds, securitizations, business loans, and consumer loans; and third, building a robust derivatives market for SOFR, which includes creating and operating a liquid market of SOFR futures and swaps.

Fallback Language

Many contracts—the legal documents underlying financial transactions—refer to LIBOR as the interest rate. Many of these existing contracts do not contain an appropriate “fallback” rate if LIBOR is unavailable, or even consider the possibility of a permanent cessation of LIBOR. As a result, the ARRC has suggested that market participants include more robust fallback language in new and amended contracts going forward. It has published recommended language for cash products on its website, www.newyorkfed.org/arrc/, and International Swaps and Derivatives Association (ISDA) has released results of consultations on fallback language for derivative contracts on its website: www.isda.org/category/legal/benchmarks/.

Cash Market

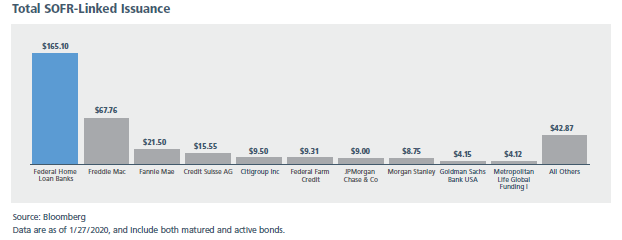

Many institutions have begun issuing floating rate debt tied to SOFR. The Federal Home Loan Bank System leads the market as the top issuer of SOFR-linked floating rate notes. Since late 2018, the System has issued over $160 billion in SOFR-linked notes, with Freddie Mac as the next largest issuer at less than $70 billion issued, as of January 27, 2020.

On the consumer side, SOFR-linked products have not yet been issued. The ARRC released a white paper on options for using SOFR in adjustable-rate mortgages (ARMs) that comply with the ARRC’s principles, meet consumer needs, and remain attractive to borrowers and investors. On February 5, 2020, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac will be required to include the new ARRC language in all single-family uniform ARMs. Further, all LIBOR-based ARMs must have loan application dates on or before September 30, 2020, to be eligible for acquisition. And finally, acquisitions of LIBOR ARMs will cease by December 31, 2020. It was also noted that the FHFA expects them to cease purchasing CMT-indexed ARMs in 2021.

In May 2019, Ginnie Mae issued the first-ever SOFR-indexed mortgage-backed security (MBS). The SOFR-indexed security was a $40 million floating rate tranche within a $265 million Real Estate Mortgage Investment Conduit (REMIC), backed by ARMs or MBS pools. The spread was 40 basis points over SOFR. In the end, the deal had to be unwound due to varying reasons.

Freddie Mac recently priced a new offering of Structured Pass-Through Certificates, including a class of floating rate bonds indexed to SOFR. Approximately $765 million settled in late December 2019, and these were backed by floating rate multifamily mortgages that were still LIBOR-based.

Derivatives Market

The derivatives market for SOFR has been growing since its inception. The Chicago Mercantile Exchange (CME) first launched 1- and 3-month SOFR futures in May 2018. While the largest futures markets are still for U.S. Treasurys and Eurodollars, SOFR futures open interest exceeded 389,000 outstanding contracts as of January 27, 2020—compared with 15.2 million contracts in U.S. Treasurys and 11.3 million contracts in Eurodollars.

The London Clearing House (LCH) offered clearing of over-the-counter (OTC) SOFR swaps in July 2018, and the CME then launched clearing for OTC SOFR swaps in October 2018. Three types of swaps have been offered thus far. The first is an overnight indexed swap, which pays SOFR versus a fixed rate. The other two are basis swaps between SOFR and either the Effective Federal Funds Rate or LIBOR. The LCH announced it had cleared over $1 trillion notional in swaps referencing SOFR in 2019, and the CME had cleared $44.5 billion in SOFR swaps as of December 2019.

Options on SOFR futures became available for trading at the CME on January 6, 2020, and 20 contracts (open interest) were outstanding as of January 27, 2020. Eurodollars and U.S. Treasurys continue to dominate this market.

The SOFR-Linked Adjustable Rate Advance

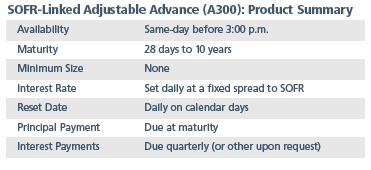

The Federal Home Loan Bank of Chicago currently offers a SOFR-linked advance to provide members an additional, flexible floating rate funding solution, as well as to help smooth the transition from LIBOR to SOFR. The A300 Adjustable Advance product is a fixed term, floating rate advance that is indexed to SOFR.

SOFR is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities. Daily trading volume of SOFR now exceeds $1 trillion, as of December 2019, compared with the estimated $500 million daily LIBOR trading volume. SOFR is published by the Federal Reserve Bank of New York each business day reflecting the prior business day’s trading (backward-looking). As a result, members get the benefit of an advance linked to a fully transaction-based index that is not easily manipulated.

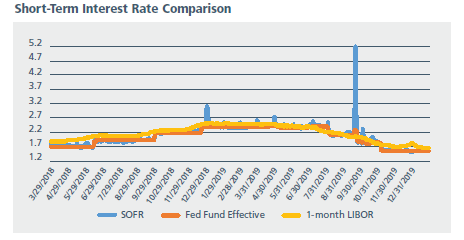

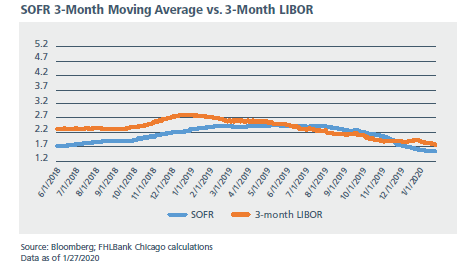

SOFR has generally been more volatile than other short-term interest rates on month- and quarter-ends due to fluctuations in demand in the repo market. On September 17, 2019, the market saw repo rates nearing 10% because of shortages in liquidity attributed to corporate tax bills, quarter-end balance sheet pressures, Treasury issuance, and declining excess reserves. As a result, the Federal Reserve Bank of New York responded with a repurchase operation in an effort to control interest rates and keep cash in the market. In the Federal Open Market Committee’s January announcement, the New York Fed stated its plans to continue the repo operation through the next few months. Further, as can be seen in the graphs below, the daily volatility of SOFR is generally smoothed out on a 3-month rolling basis, in comparison with LIBOR.

Product Features

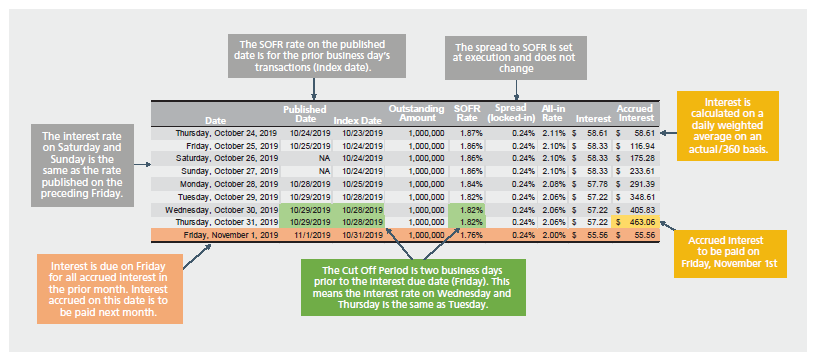

- The determination date is one U.S. Government Securities Business Day prior to the reset date.

- The final interest payment is due at maturity, using the following New York business day convention.

- The cut-off date is two U.S. Government Securities Business Days prior to any interest payment due date. Under this standard term, if a payment is due on Thursday, the interest rate for the reset dates of Tuesday and Wednesday prior will be the same as for Monday.

- This advance is prepayable only at par plus accrued interest and a prepayment fee.

- This product is available for Community Advances. FHLBank Chicago offers discounts on credit products to support its members' community lending initiatives. Eligibility guidelines are available in the Community Investment section of FHLBank Chicago's website, www.fhlbc.com.

- This advance is eligible for FHLBank Chicago's Reduced Capitalization Advance Program (RCAP). RCAP allows members to borrow with a reduced activity stock requirement, currently 2%, for the life of the advance, instead of the 4.5% requirement under FHLBank Chicago's capital plan's general provisions. Members must specifically request RCAP for an advance.

Interest Rate Explained

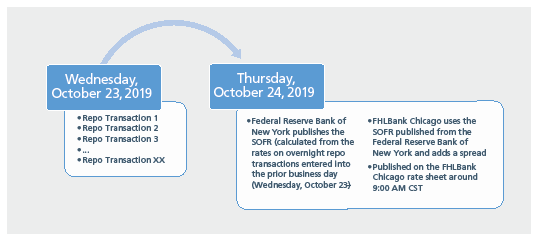

The A300 Adjustable Advance is indexed to SOFR and reset daily. The Federal Reserve Bank of New York publishes the rate each business day for the prior business day’s transactions. The rate represents a volume-weighted median of the rates on overnight repo transactions that were entered into on the previous business day and are to be repaid on the current business day.

The interest rate of the advance is the sum of: (i) SOFR one U.S. Government Securities Business Day prior to the reset date and (ii) a fixed spread (e.g., 24 basis points). See below for an example transaction with interest and payment terms applied.

Member Benefits

- Lock in medium-term liquidity indexed to short-term interest rates.

- Manage liquidity needs and/or deposit run-off in a long-term structure, while benefiting from FHLBank Chicago's low-cost funding.

- Fund adjustable-rate assets and transition away from LIBOR exposure.

Looking Ahead

Members should begin to prepare for the transition away from LIBOR. The following checklist, while not exhaustive, may be used as a starting point for your own institution to assess its LIBOR exposure:

- Review fallback language in existing loans, derivatives, and securities.

- Determine trigger events, potential substitute indices, and other relevant terms.

- Determine whether amendments are necessary or possible.

- Assess your institution's accounting, tax, and IT system, capabilities and their implications for the LIBOR transition.

- Assess collateral that may be pledged to FHLBank Chicago, the Fed, or other counterparties to determine LIBOR exposure.

- Address implementation of robust fallback language in new contracts going forward.

- Communicate with your counterparties and customers to provide information about the transition from LIBOR.

- Consider regulatory requirements, compliance risks, or disclosure risks when planning for the transition.

To Learn More

FHLBank Chicago is continually monitoring the SOFR market for liquidity and derivative transactions. It has created a resource page on the LIBOR transition, including educational materials, market developments, and important public resources for our members. The page is now available at www.fhlbc.com in the Solutions section.

If you have additional questions regarding how to better prepare for the transition, contact your Sales Director or the Solutions team at membership@fhlbc.com.

Contributors

Jessica Nick

Senior Analyst, Sales, Strategy, and Solutions

Ashish Tripathy

Managing Director, Sales, Strategy, and Solutions

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to

any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | March 2020