Expanding the Uses of Letters of Credit

Overview

Members of the Federal Home Loan Bank of Chicago (FHLBank Chicago) can apply Letters of Credit to guarantee contracts and obligations or enhance bond issuances on behalf of their customers. While the most popular application of an FHLBank Chicago Letter of Credit (LC) is collateralizing Public Unit Deposits for covering municipal deposit levels in excess of levels covered by FDIC/NCUA insurance, many other uses are often overlooked. One example is a Performance Guarantee Letter of Credit that can be utilized to guarantee construction contracts, lease payments, or insurance premiums. Another example is a Bond Enhancement Letter of Credit that can be utilized to enhance a bond issuance for the construction of commercial, municipal, or tax-exempt housing related projects. Bond Enhancement Letters of Credit can help our members strengthen and maintain local customer relationships, compete with larger, higher rated banks, provide a lower borrowing rate versus a loan, and generate fee income while leveraging the FHLBank Chicago’s strong credit rating and preserving the size of their institution’s balance sheet.This white paper will focus on three topics:

- General Overview of Structuring a Confirming Letter of Credit

- Performance Guarantee Letters of Credit

- Bond Enhancement Letters of Credit

Structuring a Confirming Letter of Credit

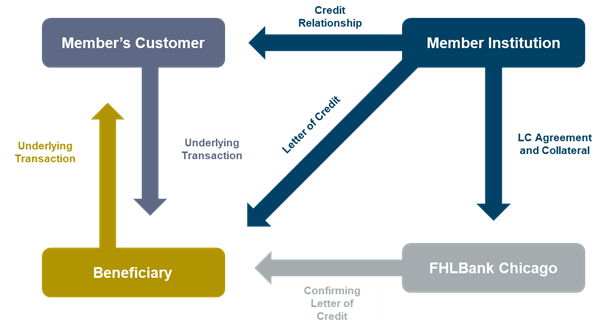

Confirming LCs serve to support or confirm a member’s obligations made under their own LC. Members may identify a customer that is in need of credit support and can issue a LC in favor of the beneficiary. This serves as the primary layer of support within the partnership between a member, their customer, and the ultimate beneficiary. Although the LC covers the credit risk of the member’s customer to fulfill the obligation, a beneficiary may ask for an additional layer of support. In this scenario, FHLBank Chicago could enter the partnership, providing a low-cost source of additional support in the form of a Confirming LC backed by the FHLBank Chicago’s long term credit rating of “Aaa/AA+” and short term credit rating of “P-1/A-1+”.

In the event of a failure to satisfy an obligation by a member’s customer, the beneficiary would first draw upon the member’s Letter of Credit. The credit relationship would primarily reside between the member institution and their customer with the contingent liability converted into an on-balance sheet asset for the member. In the event that the member were subsequently unable to satisfy the obligations, the beneficiary could then draw upon the FHLBank Chicago Confirming LC. In this situation, FHLBank Chicago would convert this obligation into an open line advance, secured by previously pledged collateral and established credit availability at the time of a Letter of Credit execution.

Figure 1:

Guaranteeing a Member's Obligations to Pay or Perform

A Performance Guarantee Letter of Credit (PG LC) can be used to secure a member’s customer’s obligation to pay or perform on a contract. The member’s initial LC provides the primary assurance to a beneficiary. When wrapped by an FHLBank Chicago PG LC, the beneficiary receives additional assurance from FHLBank Chicago that the obligation will be met. Often, establishing a Confirming LC may act as a viable alternative to more traditional collateralization methods.Common examples of PG LCs include, but are not limited to, assuring performance on construction contracts, guaranteeing lease payments, guaranteeing insurance premium payments, or providing collateral for business’ self-insured workers’ compensation liabilities.

- Construction Contracts: A Letter of Credit issued for these types of agreements may guarantee that the contractor will perform their work as specified in the contract and/or pay for services, labor, and materials. This type of LC may act as an alternative to a performance and payment bond.

- Guaranteeing Lease Payments: A Letter of Credit can be issued to a landlord to guarantee a commercial tenant’s or a member institution’s obligations under a lease agreement. In the event that the tenant breaches the contract or goes bankrupt, the LC can be drawn by the landlord. The LC can be used as an alternative to a cash security deposit and is transferable only with prior written consent from FHLBank Chicago.

- Insurance Premiums: A Letter of Credit can be issued to an insurance company, as a beneficiary, to guarantee premium payments made for insurance policies. These LCs are used to support workers’ compensation and casualty insurance policies.

- Self-Insured Workers’ Compensation: Certain businesses may apply for and become approved to insure themselves for their workers’ compensation liabilities. For example, in Illinois these businesses would apply to the Illinois Workers’ Compensation Commission (Commission), which oversees these self-insured companies. The Commission will then require a guarantee for the payment of workers’ compensation obligations, which can be an LC. Utilizing an LC to satisfy the collateral requirements of state insurance regulators frees up operating liquidity for member’s customers and wrapping it with a FHLBank Chicago LC adds FHLBank Chicago’s strong credit rating.

- For Insurance Company Members of FHLBank Chicago: By substituting collateral pledged to third-party beneficiaries such as regulators or reinsurers with a collateralized LC issued by FHLBank Chicago, members gain greater flexibility to reallocate more of their investment portfolio from highly liquid assets such as Treasuries to higher yielding assets and thus earn greater income.

Certain transactions may additionally be eligible for discounted Community pricing, subject to various requirements. Housing projects located in areas at or below 115% area median income (AMI) as well as non-housing or small business projects located in census tracts with median income less than or equal to 100% AMI (urban areas) or less than or equal to 115% AMI (rural areas) may be eligible for discounted pricing.

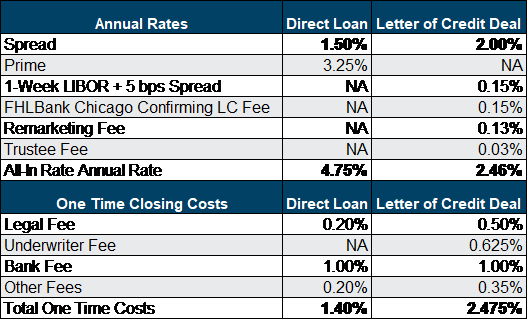

Enhancing a Bond Issuance

Confirming LCs can alternatively be issued in connection with bond financing to further enhance the financial strength of an underlying project.If a member identifies a customer who is considering a bond issuance for the purpose of building a large healthcare facility, for instance, the member may issue a direct pay LC to support the bond issuance. A direct pay LC provides assurance to the deal’s beneficiaries, the bondholders, and boosts the credibility of the facility’s developers. The member institution facilitates the collection of principal and interest payments from the developers as well as the subsequent distribution to the trustee for the benefit of the bondholders. In doing so, the member institution is guaranteeing the delivery of the principal and interest payments, whether they be directly from the developers or under the terms of the direct pay LC. A direct pay LC can be an attractive option for a member institution in that it may help a member preserve the composition of their balance sheet, requires less up-front liquidity, and generates fee income immune from interest rate risk.

Figure 2:

If a member’s direct pay LC alone cannot achieve the most attractive financing options for the issuance, FHLBank Chicago can subsequently enter the deal to further enhance the bond issuance. Combining an FHLBank Chicago Confirming Bond Enhancement LC with an underlying direct pay LC from a member institution can benefit both members and their customers.

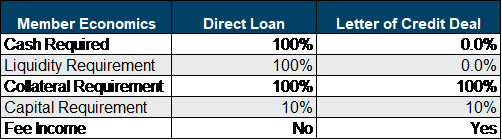

For a member, utilizing their own LC and partnering with FHLBank Chicago may allow the institution to compete with larger, more highly rated banks, thus maintaining or improving local customer relationships. The deal as a whole would be able to leverage FHLBank Chicago’s long term “Aaa/AA+” credit rating and short term “P-1/A-1+” credit rating, ultimately benefiting the customer by achieving more attractive financing terms for the bond issuance. As shown in Figure 3 below, LC deals may have a higher one time start-up cost but could provide significant savings on annual costs to the end borrower.

Figure 3:

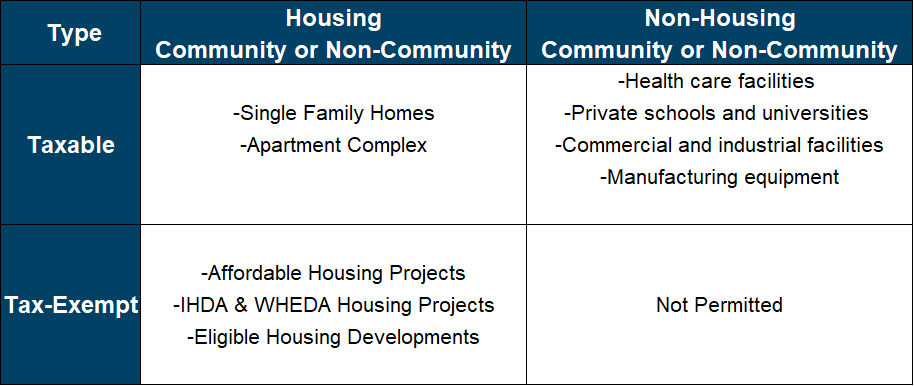

Bond Enhancement LCs may be utilized to support a variety of both taxable and tax-exempt projects including, but not limited to, bond issuances for housing projects, municipal projects, taxable commercial projects, or even as alternatives to premium financing for life insurance policies for high net worth individuals. Projects that provide support for community economic development or affordable housing projects can additionally qualify for reduced pricing on the FHLBank Chicago Confirming LC.

Figure 4:

A unique addition to our Bond Enhancement LC is our member’s ability to potentially structure traditional loans as an FHLBank Chicago enhanced bond transaction. This allows members to evaluate whether non-public projects (i.e. commercial and industrial loans) can benefit from the aforementioned lower total financing costs by structuring the financing as a bond transaction wrapped with an FHLBank Chicago LC.

Confirming LCs issued by FHLBank Chicago in support of bonds or private debt placements can ultimately enhance the financial strength of an underlying project. Not only will the LC feature facilitate a favorable interest rate on behalf of the issuer, it can also provide a member financial institution the opportunity to boost their competitiveness, preserve composition of their balance sheet, and generate additional fee income.

Conclusion

While FHLBank Chicago members might be aware of the benefits of using Letters of Credit for the purpose of providing municipal depositors’ coverage beyond FDIC/NCUA insurance thresholds, expanded uses can benefit members, their customers and communities. In many cases, an FHLBank Chicago Letter of Credit can enhance a project that otherwise may not have been viable.Whether it’s an opportunity to generate fee income, outbid a competitor in backing a bond, supporting a self-insurance program, or covering a customer’s performance obligation; it may be worth your while to explore some of these expanded uses of Letters of Credit and discuss them with your Sales Director.

To Learn More

Contact your Sales Director or email membership@fhlbc.com for more information on how to expand your usage of Letters of Credit or other ways the FHLBank Chicago can assist your institution.

Contributors

|

Danny Magdaleno Membership Solutions Analyst Sales, Strategy, and Solutions |

|

Nick Simoncelli Senior Analyst Sales, Strategy, and Solutions |

|

Erin Hunter Director Sales, Strategy, and Solutions |