Benefits of Forward Starting Interest Rate Swaps

Overview

Many Federal Home Loan Bank of Chicago (FHLBank Chicago) members are experiencing slowing loan demand, while an influx of deposits continue to add more liquidity to their balance sheets. Deploying that liquidity to fixed rate securities or loans can create a new and valuable source of income. However, institutions may need to hedge the interest rate risk from funding fixed rate assets with floating rate liabilities such as deposits.

Matching fixed rate advances from FHLBank Chicago to those assets is a great hedging solution. However, members that do not need wholesale funding today can utilize strategies that take advantage of today’s low rates, but settle in the future. This can be done with a forward starting fixed rate advance which lock a fixed rate for the future. Members may also use a variety of forward starting swaps with the floating leg based on overnight indices such as Fed funds, known as an overnight index swap (OIS), or swaps based on 1-month or 3-month LIBOR. The Financial Accounting Standards Board (FASB) allows members to establish a cash flow hedge relationship by forecasting the issuance of rolling short-term liabilities combined with a forward starting swap. This strategy, called the “forward swap + rolling,” is economically advantageous when compared to using forward starting fixed rate advances.

While most financial institutions have access to low cost liquidity today, the upcoming presidential election and volatility from the pandemic could change the landscape quickly. Consider using the forward starting swap and roll strategy to protect your funding in the future.

Benefits of the Strategy

- Take advantage of low swaps rates today for future settlement.

- Avoid adding liquidity today, but ensure liquidity in the future.

- Match existing retail or wholesale funding maturities with forward swap settlements to hedge against refunding at higher rates.

- Earn more income by holding fixed rate assets such as mortgage loans, or corporate and municipal bonds on balance sheet by hedging the interest rate risk. The market value of the swap would offset losses on these securities.

- Lower effective rate relative to locking in forward starting fixed advances.

- Uses hedge accounting rules to your advantage, moving price and income volatility off the income statement.

Forward Starting Interest Rate Swap

Interest rate swaps are derivative contracts where two parties agree to exchange a fixed or floating rate cash flow for the other over a period of time. Forward starting swaps delay this exchange until a specified settlement date in the future. After settlement, parties will exchange the difference of interest cash flows between the fixed swap rate and that of the floating rate index, as it resets over time. See Figure 1 below which illustrates a normal interest rate swap.

Figure 1:

Swap dealers calculate the forward fixed swap rate by equating the present value of all of the fixed payments to the present value of the expected floating rate payments implied by the forward curve. The forward curve is the market's current expectation of where rates may be in the future using today's rates as a baseline. Therefore, forward interest rate swaps allow members to essentially capture the current rate environment and lock in those rates for the future.

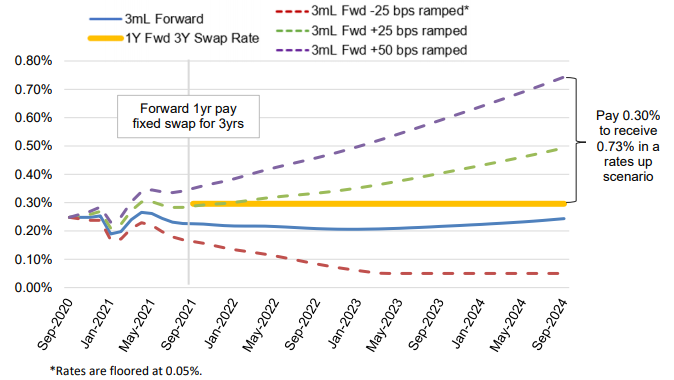

Choosing a “pay-fixed-and-receive-floating” swap is a method to convert fixed rate assets to floating, making them asset sensitive at a future point. Asset sensitive balance sheets benefit if rates move up in the future. The illustration in Figure 2 below shows the forward curve of 3-month LIBOR (3mL) and three different interest rate shock scenarios, which are ramped (incrementally adjusted each month) over 4 years. The example swap would start after one year, and then would swap cash flows with 3mL for 3 years thereafter. The fixed leg would be locked at 0.30%, while 3mL would vary over time. The pay-fixed forward swap would benefit members if interest rates rise in the future, relative to only receiving a fixed rate asset. The risk of falling rates is mitigated as short term interest rates approach zero.

Figure 2:

Replace Liabilities with a Forward Starting Swap + Roll Strategy

FHLBank Chicago members with liabilities set to mature in the near to distant future should consider establishing a cash flow hedge using a forward starting swap. Match the future maturity date of the outstanding fixed rate liability, such as an advance or brokered CD, with the settlement date of a forward swap. Members can pair the swap with a short term advance on the swap settlement date, and roll the advance until swap maturity to create “swap + rolling” funding. The swap will pay out interest based on the future rate of the floating leg index to offset the cost of future short term funding. This strategy helps to increase liability duration while rates are low, hedge against having to refund at higher rates with inexpensive insurance, and ensure future funding now when liquidity could be scarcer later on.

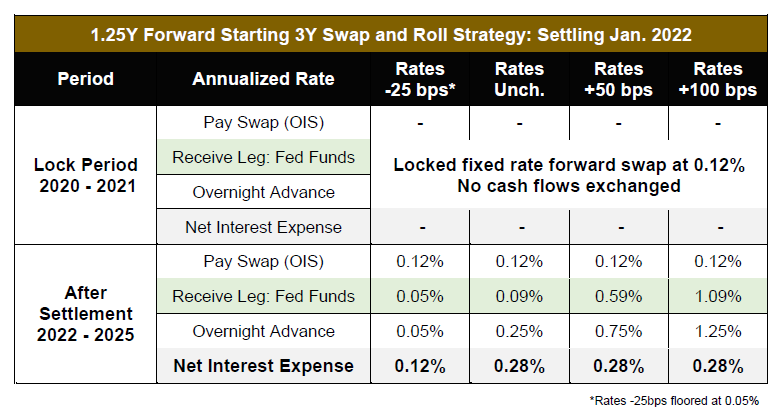

The table below in Figure 3 illustrates an example of a forward starting swap and roll strategy. The member would execute a forward starting pay fixed OIS on Fed funds to settle at the start of 2022. The quoted annualized rate of 0.12% would be swapped for the Fed funds effective rate at settlement. The member would then roll FHLBank overnight advances starting in 2022 for three years to match the swap. The interest cost of the advance would be offset by the receive leg of the swap. In this example, short term interest rates are shocked to show the effect on net interest expense. As rates move down to an estimated floor of 0.05%, the cost of the overnight advance is completely offset by the receive Fed funds leg of the swap. The net cost is estimated at 0.12%. As rates move up, the overnight advance stays just above the adjusted Fed funds level. That cost would again be offset by the receive floating leg of the swap, creating a synthetic fixed rate estimated at 0.28% for 3 years. As a comparison, the 3-year fixed advance rate as of September 9, 2020 was 0.59%.

Figure 3:

Current Advantage of the Forward Swaps Curve

Following the COVID-19 pandemic, short term indices dropped significantly when the Federal Reserve lowered their Fed funds effective target range between 0-25 bps. Forward curves moved lower with it, and remain at attractive levels today. Members can execute forward starting fixed term advances to lock-in both the rate and funding for the future, if flush with liquidity today.

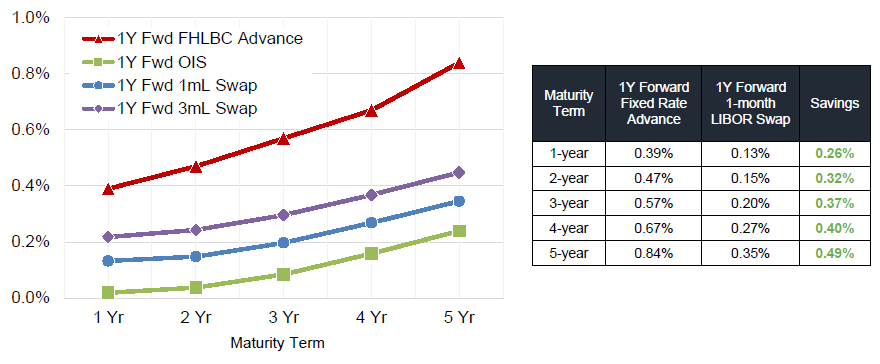

Alternatively, executing a forward starting swaps with future short term advances is even more attractive. The components of the strategy are: 1) execute a forward starting swap, 2) execute a short term advance matching the term of the swap’s floating leg on settlement day of the swap, 3) continue to execute regular short term advances for the life of the swap. This strategy avoids the term premium in FHLBank advances, and could save members as much as 49 bps when using a 1Y forward 5Y 1-month LIBOR swap relative to the same tenor forward starting advance. See Figure 4 below to compare forward starting swaps curves relative to forward starting FHLBank Chicago advances.

Figure 4:

Most forward swaps are based on LIBOR, but can be structured on a variety of other short term indices approved by FASB. These include OIS based on Fed Funds, the secured overnight financing rate (SOFR), or the Securities Industry and Financial Markets Association (SIFMA) swaps based on variable rate municipal notes. Members concerned over the upcoming LIBOR transition can execute and hedge with swaps based on these indices.

Cash Flow Hedge Accounting Considerations

Interest rate swaps are derivatives which experience price volatility, and are typically marked to market against income by default. However, with the forward starting swap + roll strategy, FASB established cash flow hedge relationship rules allowing for fair value changes in the swap to be recorded in accumulated other comprehensive income (AOCI) until the final reset date when it moves to the income statement, as the swap price moves closer to par near its maturity date. Members should establish and document a hedge relationship according to accounting standards code (ASC) 815-20-25. The hedge relationship can be set against current or future forecasted liabilities applicable to the strategies discussed in this paper.

Please consult your accounting staff for details about your specific situation.

To Learn More

Contact your Sales Director or email membership@fhlbc.com for more information on this strategy or other tactics to assist your institution.

Contributors

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. Historical dividend rates provided for informational purposes only; future dividends at the Board’s discretion and subject to change.