Annual Eligibility Certification Supporting Documents: Understanding Requirements and Guidance on Upload

Annually, FHLBank Chicago Participating Financial Institutions (PFIs) and servicers that have sold or serviced one or more mortgage loans under the Mortgage Partnership Finance® (MPF®) Program within the calendar year are required to submit a complete accurate Annual Eligibility Certification (AEC) Form OG1, certifying and affirming compliance with all of the provisions and requirements of the Applicable Agreements and the Guides as a condition of continuing eligibility.

The Form OG1 will become available on eMPF® January 1, 2025. FHLBank Chicago member institutions must submit the completed form and supporting documentation via the eMPF website by January 31, 2025.

As part of the AEC, PFIs, and servicers must upload supporting documents and indicate on Form OG1, which supporting documents have been uploaded or are to be uploaded.

Understanding Which Supporting Documents Must Be Uploaded

The mandatory supporting documents for AEC submission depend on the PFI or servicer’s PFI AEC Status (seller, servicer, or seller/servicer). For example, a servicer is not required to furnish the Quality Control (QC) Summary Report (refer to row 3 in the table below).

Each supporting document uploaded directly corresponds to a checkbox in Form OG1 Section B (refer to leftmost column in the table below).

To determine what supporting documents must be uploaded and which Form OG1 Section B boxes must be checked, a PFI or servicer may consult the middle column of the table below (i.e. “Required For”). If the description matches the PFI or servicer, the supporting document must be uploaded, and the corresponding Form OG1 Section B box must be checked.

| Supporting Documents Guidance | ||

|---|---|---|

| OG1 Section B Box # | Required For | Details |

| 1 | All PFIs and Servicers who responded “No” to a question in Form OG1 Section A | Explanation for “No Response.” If a PFI or servicer responds “No” to any questions A1a-A1d on the AEC Form OG1, they must provide a written explanation for the response. Please note that this includes A1d. If a PFI or servicer is not reporting to all four (4) credit reporting bureaus (Experian, Equifax, Innovis, and TransUnion), then they must upload a written explanation for this response. This written explanation may be used to assist our FHLBanks in working with the PFI or servicer to remedy the issue, or in support of a waiver for being out of compliance with the MPF Program Guide requirements. If a PFI or servicer responds “No” to HMDA Reporting question, they must provide a written explanation for why PFI or servicer is not required to collect, report HMDA data. If a PFI or servicer responds “No” to APL Software question, they must provide APL procedure demonstrating that APL software is not necessary to ensure compliance with anti-predatory lending laws, rules, and regulations as they apply to any origination or servicing practices. |

| 2 | All PFIs and servicers who had exam or audit findings | Exam or audit findings and summary of how findings were addressed and corrected. Exam findings may come from (but are not limited to) the following agencies: - State or federal regulator - Government agency (including VA, HUD, FHFA, or RHS) - Fannie Mae, Ginnie Mae, or Freddie Mac - Other mortgage loan investors |

| 3 | All sellers and seller/servicers | Quality Control Summary Report with the following qualities: - Prepared and disseminated relatively recently - Provided to senior management - Clearly represents both pre-closing and post-closing reviews - Clearly demonstrates that both pre-closing and post-closing reviews were conducted to the standards described in Chapter 8 of the MPF Program Guide - Includes detailed information on most severe defects - Includes trend analysis - Compares target defect rate to actual defect rate - Includes senior and/or management responses, if applicable - Includes corrective action plans, if applicable - Quantity of QC reviews demonstrating that the PFI or Servicer conducted sufficient reviews to meet the sample size rules established by the MPF Program Guide. Please note that if only 1 MPF loan was originated during the applicable AEC period, that one loan needs to have had pre- and post-closing QC conducted to satisfy this requirement. Similarly, if no loans were sold into the MPF Program during the applicable AEC period, the PFI is exempted from this requirement, as there were no MPF loans to conduct QC on and the MPF Program Guides do not apply the same QC standards to portfolio loans as MPF loans. |

| 4 | All PFIs and servicers who made substantive revisions to in-house QC Plans not approved by FHLBank Chicago | Redlined QC Plan clearly reflecting changes made |

| 5 | All PFIs and servicers who have been specifically requested by FHLBank Chicago to furnish additional documentation or information | Self-explanatory |

| 6 | All PFIs and servicers who wish to provide additional documentation or information | Self-explanatory |

Uploading Supporting Documents

Like completing the AEC Form OG1, supporting documents are uploaded via eMPF. FHLBank Chicago PFIs can login to eMPF at empf.com. Please see the login guidance below:

- Use the email associated with your eMPF account to login. If you have forgotten your password, you can retrieve it by clicking “Forgot Password” on this screen.

- If you do not have eMPF credentials, you will need to be granted eMPF access for your institution. This can be done in two ways:

- If your institution has a eMPF Security Administrator, that person can grant you eMPF access within eMPF. You would then receive eMPF credentials and instructions via email.

- If your institution does not have a Delegations of Authority Security Administrator, you should work with your FHLBank representative to have an authorized signer at your institution complete a Supplemental Delegations of Authority form to add you as an authorized eMPF user. After completing and returning this form to your FHLBank representative, you would receive eMPF credentials and instructions via email. To request a Supplemental Delegations of Authority form, please contact your FHLBank representative.

Additionally, if you are an FHLBank Chicago member have not yet registered for our new login experience to access the MPF Program applications, including eMPF, you will be prompted to complete the mandatory registration process when you next login. You may also register by going to register.empf.com.

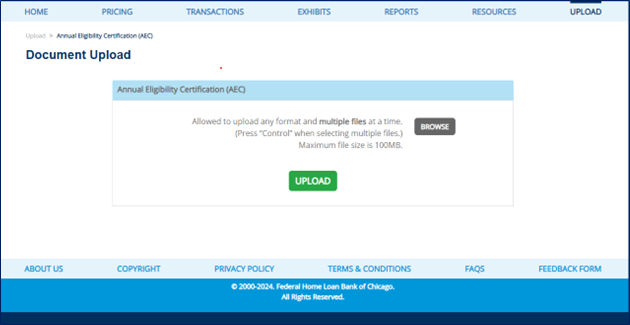

Once an authorized user is logged into eMPF, supporting documents may be uploaded by selecting on “Upload” in the top navbar, then selecting “Annual Eligibility Certification (AEC):

Click “Browse” will allow users to select the files on their computer to be uploaded as supporting documents. Files of any format may be uploaded, and multiple files may be uploaded at the same time. The selected files will be uploaded when the user clicks “Upload.”

When a PFI or Servicer has finished uploading all required supporting documents, and has checked the appropriate boxes in AEC Form OG1 Section B, they should complete the rest of Form OG1 and submit. For guidance on the rest of the AEC, please refer to our job aid on the topic, register for our upcoming live webinar, or access our on-demand webinar.