Advance Discounts Extended Through September 2024 - Call to Take Advantage

June 25, 2024

Federal Home Loan Bank of Chicago (FHLBank Chicago) members continue to find value in borrowing longer-term fixed-rate advances in today’s rising interest rate environment. In our ongoing commitment to support your liquidity needs, we are extending our long-term, 5 basis point (bps) discount on callable, fixed-rate, and amortizing advances through the end of the third quarter, September 30, 2024. In order to take advantage of this, you need to call us directly at 855.345.2244, option 1. The daily maximum limit is $30 million across all three specials.

Members can also add the symmetrical prepay feature to the advance, which allows them to prepay the advance and monetize their gains if rates rise by a sufficient amount. The fixed-rate and amortizing advances can also be forward starting, locking in the discount and low, long-term rates now, without immediate funding.

Top Member Strategies That Benefit From Our Advance Specials

The discounted advances paired with a lower “all-in” cost due to the Dividend Effect remain among the cheapest sources of term wholesale funding, even as competing funding sources have recently become more expensive in the belly and long end of the curve. Members continue to find value in longer term advances, pairing the funding with various strategies including but not limited to those outlined below:

- Add Call Protection to Hedge Mortgage Portfolios – The fixed-rate callable advances structure gives the member the option to cancel an advance. This is an excellent tool to hedge prepay risk inherent in residential mortgage assets. Callable advances are available with both Bermudan (quarterly, semi-annual, annual) and European (single date) option structures.

- Investment Leverage – Match funding long-term fixed-rate securities such as mortgage-backed securities (MBS), commercial mortgage-backed securities (CMBS), municipal bonds, and corporate bonds is a popular strategy with many of our members. Additionally, some members take our fixed-rate advance, swap it to floating, and match fund floating rate securities such as collateralized loan obligations (CLOs), collateralized mortgage obligations (CMOs), and FFELP Student Loans. The matched cash flows under this special help generate locked-in spread income to support net interest margin (NIM), enabling you to hedge interest rate risk and benefit from asset duration.

- CRE and Multi-Family Loan Leverage – Our members actively utilize advances under these specials to fund long-term prepay protected commercial real estate (CRE) and multi-family loans. Safeguard your liquidity for the life of the loans through amortizing or fixed-rate advances with the specials to capture a stable NIM.

- Forward Start Advances to Roll Upcoming Maturities – Capture today’s rates for tomorrow’s needs. Many of our members used these specials to forward start an advance on the date of an upcoming funding maturity and ensure liquidity for the future.

- Extend Liability Duration to Help with ALM – Execute longer-term advances under these specials to increase liability duration. Members have taken advantage of the funding specials to create a more asset sensitive balance sheet. Let us help you meet your asset liability management (ALM) goals.

How to Transact

Terms and conditions are subject to change and are updated for review at the end of this Notes From the Funding Desk. These advance specials are not eligible for Reduced Capitalization Advance Program (RCAP).

Current advance rates pre-discount can be found on our daily rate sheet. To execute, you must call the Member Transaction Desk at 855.345.2244, option 1. Advances executed on eBanking are not eligible for the pricing discount. Our Member Transaction Desk is available to ensure you receive this discount and are looking forward to your call.

Questions?

Please reach out to your Sales Director with any questions.

Terms and Conditions

Members may receive a 5 bps discount to the regular advance rate under the following conditions:

Universal Terms for All Specials:

- All advances must be fully capitalized and are not eligible for the RCAP.

- Members may execute multiple specials in a day, but individual terms apply and discounts cannot be combined.

- Daily maximum of $30 million principal value inclusive of all three specials.

- Eligible through September 30, 2024.

Specifics of Each Special:

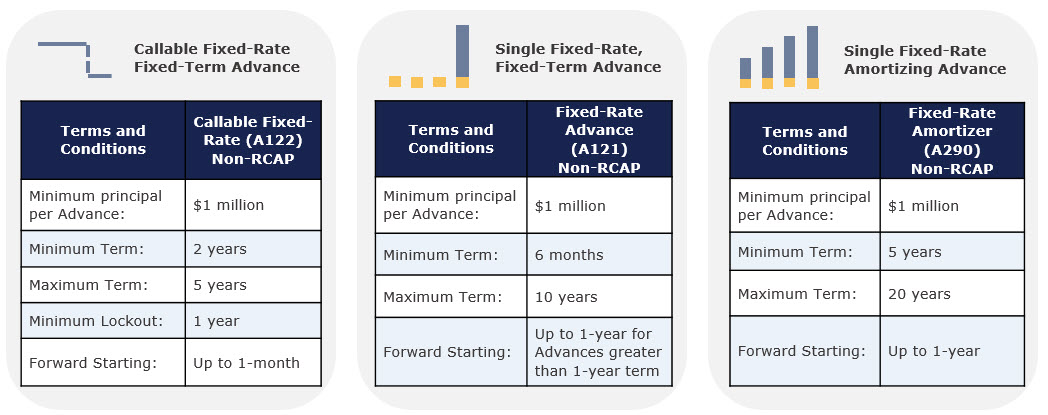

1. Callable Fixed-Rate Advance (A122)

Applies to any callable fixed-rate advance (A122) with the following conditions:

- The principal value of each advance must be at least $1,000,000 or greater.

- The maturity date of each advance must be at least two years or greater than the settlement date, and cannot exceed five years from the settlement date.

- The first call date must be at least one year or greater than the settlement date.

- Members may forward start the advance, but the settlement date cannot exceed one year from the execution date.

2. Single Fixed-Rate Fixed-Term Advance (A121)

Applies to any fixed-rate fixed-term advance (A121) with the following conditions:

- The principal value must be at least $1,000,000 or greater.

- The maturity date must be at least six months or greater than the settlement date and cannot exceed 10 years from the settlement date.

- Members may forward start the advance with a one-year term or longer, but the settlement date cannot exceed one year from the execution date.

3. Single Fixed-Rate Amortizing Advance (A290)

Applies to any individual fixed-rate amortizing advance (A290) with the following conditions:

- The principal value must be at least $1,000,000 or greater.

- The maturity and amortization date must be at least five years or greater than the settlement date, and cannot exceed 20 years from the settlement date.

- Members may forward start the advance, but the settlement date cannot exceed one year from the execution date.

All advances must be fully capitalized and are not eligible for the Reduced Capitalization Advance Program (RCAP).