FHLBank Chicago Announces Q1 2025 Financial Highlights

The Federal Home Loan Bank of Chicago (FHLBank Chicago) today announced its preliminary and unaudited financial results for the first quarter of 2025.

“As we embark on a new year, we reaffirm our commitment to being a strong and reliable source of liquidity to our members and the communities they serve,” said Michael Ericson, president and chief executive officer of FHLBank Chicago. “Our financial success enables us to reinvest through our members back into our district with lending and grant programs that increase housing supply and affordability, stimulate local economies and create more resilient communities."

First Quarter 2025 Financial Highlights

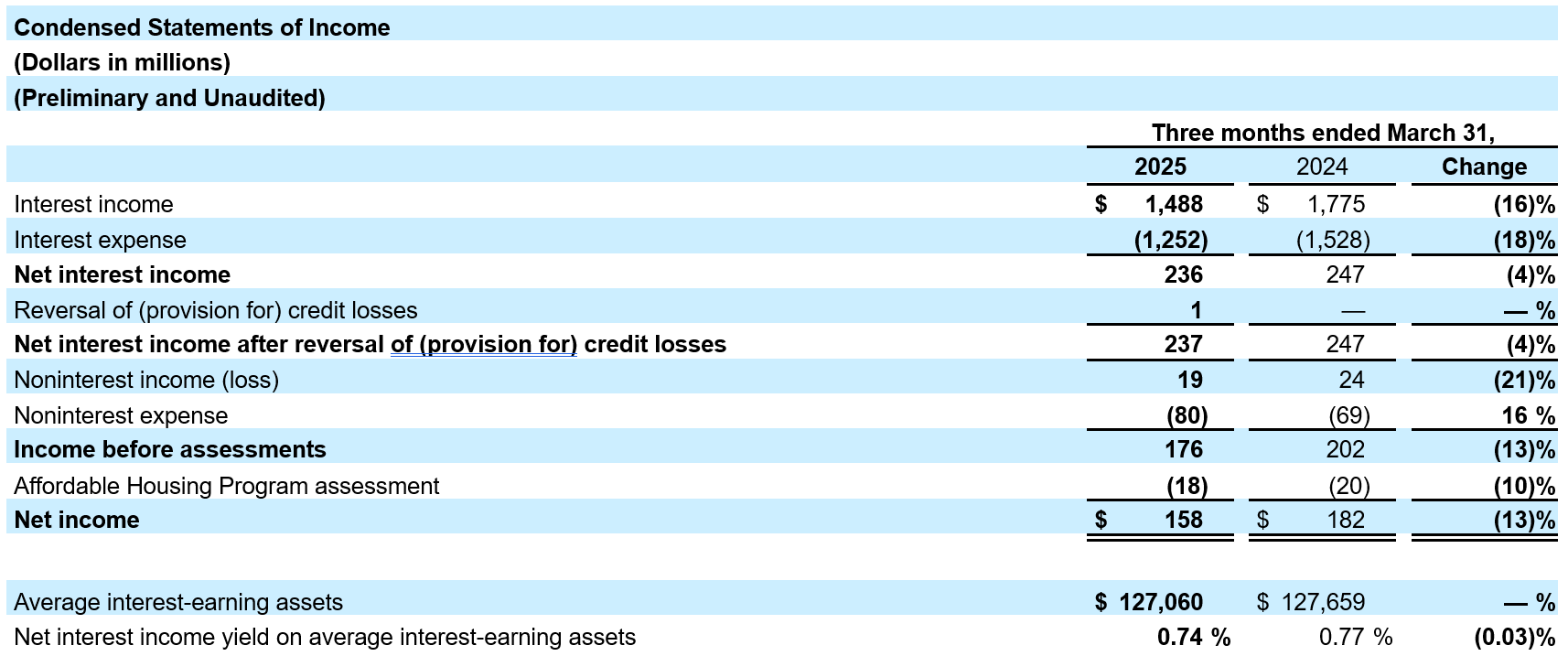

- Net income was $158 million, compared to $182 million for the first quarter of 2024 due, in part, to interest rates declining quarter-over-quarter, decreasing net interest income. Additionally, the rise in noninterest expense from increased contributions to housing and community development initiatives also contributed to the decline in net income.

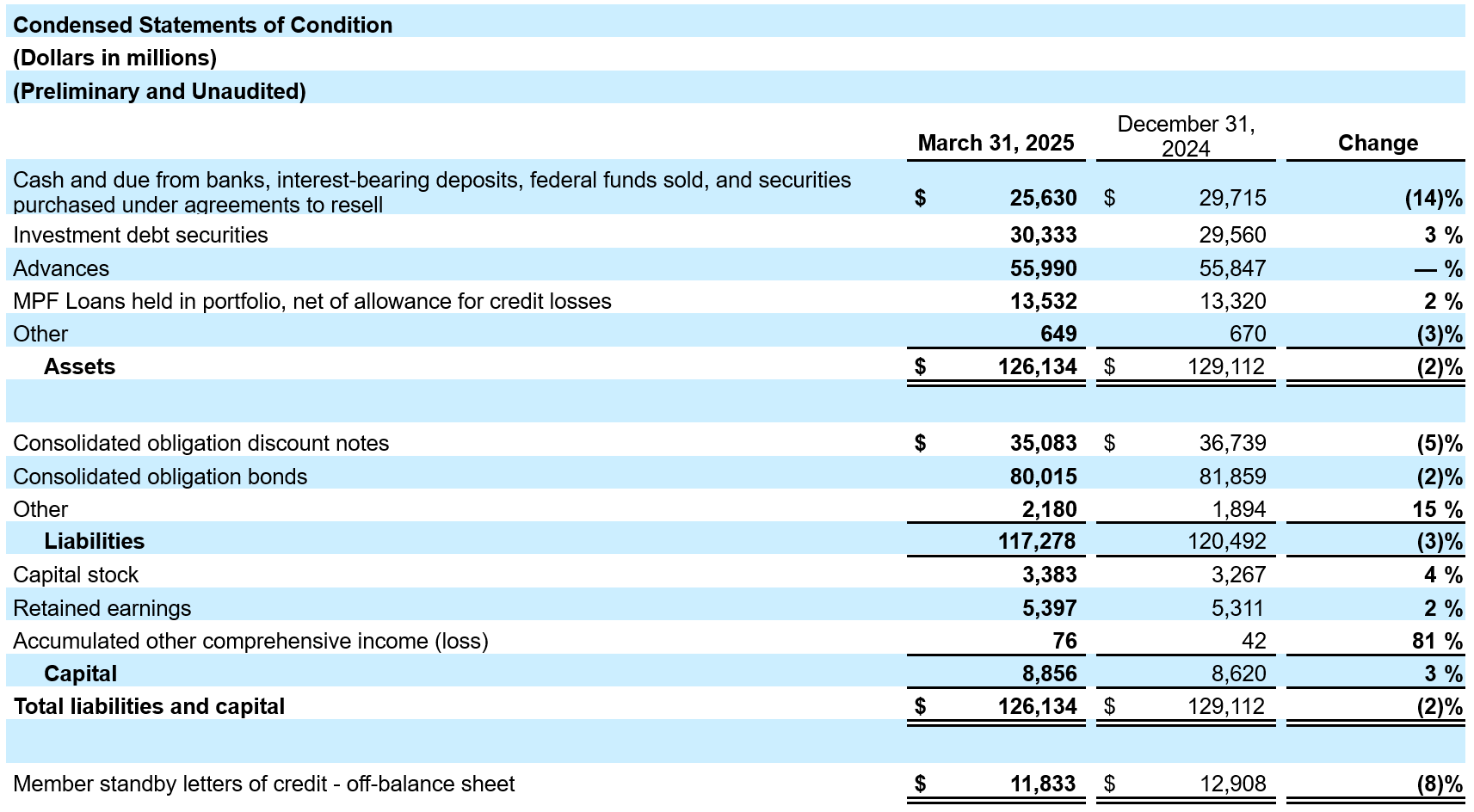

- Total assets decreased to $126.1 billion, compared to $129.1 billion at December 31, 2024, with the change mostly due to a decrease in our liquidity portfolio.

- Advances outstanding remained stable at $56.0 billion, compared to $55.8 billion at December 31, 2024.

- Mortgage loans held for portfolio through the Mortgage Partnership Finance® (MPF®) Program increased to $13.5 billion, compared to $13.3 billion at December 31, 2024, primarily attributable to new acquisition volume that outpaced paydown activity.

Ongoing Commitment to Housing and Community Development

FHLBank Chicago has allocated $52 million toward its 2025 Affordable Housing Program (AHP) General Fund, to subsidize the acquisition, new construction, and/or rehabilitation of affordable rental or owner-occupied housing. The competitive round will be open May 12 through June 20, 2025.

The 2025 Downpayment Plus® (DPP®) grant programs opened this February with a budget of $46 million. These programs allow participating members to help their income-eligible borrowers with down payment and closing costs of up to $10,000.

To help members fund affordable housing and economic development needs in their communities, FHLBank Chicago offers Community Advances at below market rates and $365 million was funded in the first quarter of 2025.

The MPF Program has an impact on housing finance and affordability. During the first quarter of 2025, 39% of mortgages purchased for investment or securitized through MPF products at FHLBank Chicago were made to low-income borrowers or communities.

Additionally, FHLBank Chicago has committed more than $8 million to its Community First® grant programs in 2025 to target affordable housing development and expand access to financial education.

For more financial details, please refer to the Condensed Statements of Income and Statements of Condition below. The Form 10-Q for the quarter ending March 31, 2025, is expected to be filed with the Securities and Exchange Commission (SEC) next month.