FHLBank Chicago Announces 2024 Financial Highlights

Net income of $620 million, with $168 million in contributions to support affordable housing and community investment

The Federal Home Loan Bank of Chicago (FHLBank Chicago) today announced its preliminary and unaudited financial results for 2024.

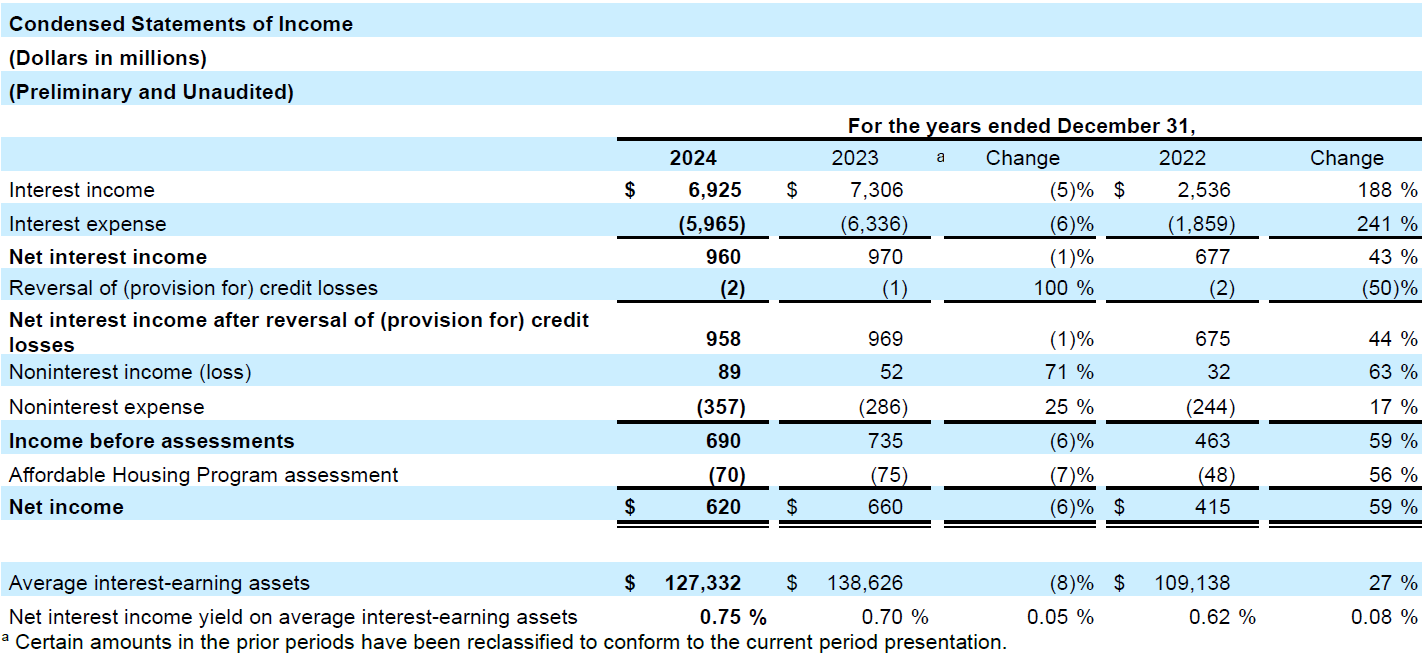

FHLBank Chicago expects to report net income of $620 million for 2024 when it files the Form 10-K with the Securities and Exchange Commission (SEC) next month. In 2024, FHLBank Chicago recognized $70 million through its Affordable Housing Program to be awarded through its members as affordable housing development grants to increase the housing supply or disbursed as down payment assistance grants to make homeownership more accessible in 2025. In 2024, FHLBank Chicago provided an additional $98 million in community investment and economic development grants and subsidized low-cost advances to members. In total, FHLBank Chicago provided $168 million in 2024 to support the affordable housing and economic development needs of its members, helping to create thriving communities across Illinois and Wisconsin.

“Over the past year, our financial strength enabled FHLBank Chicago to innovate and expand our products and programs to create stronger communities in partnership with our member financial institutions.” said Michael Ericson, president and chief executive officer of FHLBank Chicago. “We remain committed to supporting our members through all economic cycles, providing reliable, short-term liquidity and long-term funding to support housing finance and community investment.”

2024 Financial Highlights

- Net income was $620 million, compared to $660 million for 2023, driven by decreased advance balances in 2024 and an increase in noninterest expense.

- Noninterest expense was $357 million, an increase of $71 million compared to 2023. The increase was largely driven by increased contributions of $98 million to housing and community development initiatives, compared to $28 million for 2023.

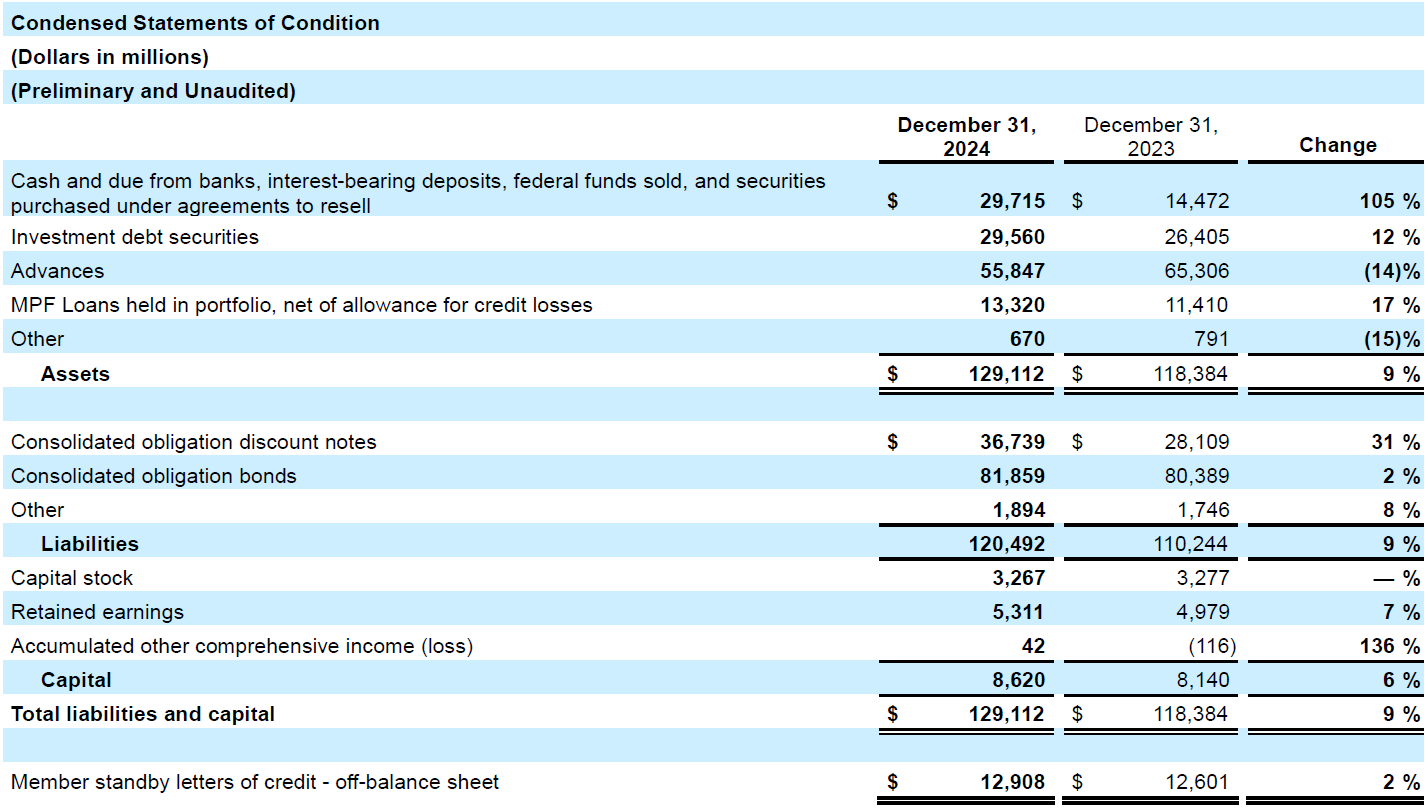

- Total assets increased to $129.1 billion, compared to $118.4 billion at December 31, 2023, with the change primarily due to an increase in the liquidity portfolio.

- Advances outstanding decreased to $55.8 billion, compared to $65.3 billion at December 31, 2023. This decrease was mostly due attributable to depository members experiencing lower funding needs on their balance sheets along with reduced loan demand, which resulted in paydowns. Advances maturing with a former captive insurance company member also contributed to this decrease.

- Mortgage loans held in portfolio through the Mortgage Partnership Finance® (MPF®) Program increased to $13.3 billion, compared to $11.4 billion at December 31, 2023, primarily attributable to new acquisition volume that outpaced paydown activity.

For more financial details, please refer to the Condensed Statements of Income and Statements of Condition below. FHLBank Chicago’s Form 10-K for the year ending December 31, 2024, is expected to be filed with the SEC next month.

Success in Housing and Community Development

- Over $1.9 billion was funded in below-market rate Community Housing Advances, Community Development Advances, and Community Small Business Advances through year-end 2024 to support over 7,300 housing units and more than 7,800 jobs.

- The Community Impact Advance Pilot Program was established in 2024 to amplify and incentivize select affordable housing and community development activities, and over $550 million was funded through year-end 2024.

- Through the Affordable Housing Program (AHP) General Fund, over $47 million in grants were awarded to help finance 35 affordable housing projects in 2024. In partnership with 24 member financial institutions, these funds will support the acquisition, rehabilitation, and new construction of more than 1,300 housing units.

- More than $42 million was disbursed through the Downpayment Plus® (DPP®) Program in 2024 to provide downpayment and closing cost assistance to over 4,400 homebuyers in partnership with 223 member financial institutions.

- Over $16 million was awarded through the Community First® grant programs in 2024 to assist the growth and development of more than 500 small businesses, expand access to homebuying counseling to 29 organizations, and provide over 60 internships and fellowships across 14 organizations focused on affordable housing development.