FHLBank Chicago Increases Funding for Housing Counseling Resource Program

In support of its mission to provide liquidity to members and support affordable housing and community development, the Federal Home Loan Bank of Chicago (FHLBank Chicago) is proud to announce an increase of $1.5 million for its Community First® Housing Counseling Resource Program (HCRP) for the current program year. In 2024, a total of $3.5 million has been allocated to the Illinois Housing Development Authority (IHDA) and the Wisconsin Housing and Economic Development Authority (WHEDA), bringing the total funding for this vital program to $7.5 million over the past three years. FHLBank Chicago continues to support housing agencies that guide customers through financial literacy and pre-purchase counseling, to empower individuals with the knowledge and resources needed to achieve sustainable homeownership across Illinois and Wisconsin.

FHLBank Chicago launched the HCRP in 2022 to provide grants to HUD-certified housing counseling agencies offering financial coaching, credit readiness, and support along the homebuying journey. These essential services help low- and moderate-income individuals overcome barriers to homeownership, ultimately contributing to their communities. IHDA and WHEDA are key administrators of the program, partnering with 30 beneficiary organizations across the two states to ensure comprehensive coverage.

“Thanks to our partnerships with IHDA and WHEDA, we’ve seen many positive impacts for households served through our Housing Counseling Resource Program,” said Katie Naftzger, Vice President, Community Investment Officer, FHLBank Chicago. “Our heightened funding for this program affirms our dedication to promoting sustainable homeownership, financial resiliency, and wealth-building for underserved populations across Illinois and Wisconsin.”

In 2023, the Housing Counseling Resource Program helped over 27,000 households receive education through beneficiary agencies, with over 2,000 eventually purchasing homes. Notably, these agencies are effectively reaching the most under-resourced communities, with over 80 percent of participants falling below 80 percent of the Area Median Income (AMI). Over half of the participants identify as BIPOC (Black, Indigenous, and People of Color), and nearly 25 percent identify as Hispanic.

“Together, FHLBank Chicago members and IHDA are bringing additional resources to traditionally underserved communities across Illinois, to help lower barriers to homeownership for individuals and families,” said IHDA Executive Director Kristin Faust. “Through targeted outreach, housing counseling, and down payment assistance, we are helping those who thought of homeownership as a dream but are now making it a reality. These new homeowners can now build financial security and put down roots in their community. IHDA appreciates our strong partnership with FHLBank Chicago as we work to increase homebuying opportunities throughout Illinois.”

Photo caption: Angela and Luis, an immigrant couple living in Elgin, Illinois, received housing counseling from Consumer Credit Counseling Services (CCCS), a HCRP beneficiary organization. They also secured an FHLBank Chicago Downpayment Plus® Program grant through Midland States Bank.

As states face ongoing housing affordability challenges, FHLBank Chicago remains committed to expanding services to low- and moderate-income homebuyers through collaboration with members and local community organizations.

“We believe everyone deserves a place to call home, and our partnership with FHLBank Chicago is instrumental in supporting that effort. Together, we're building stronger, more vibrant communities," said WHEDA Executive Director and CEO Elmer Moore, Jr.

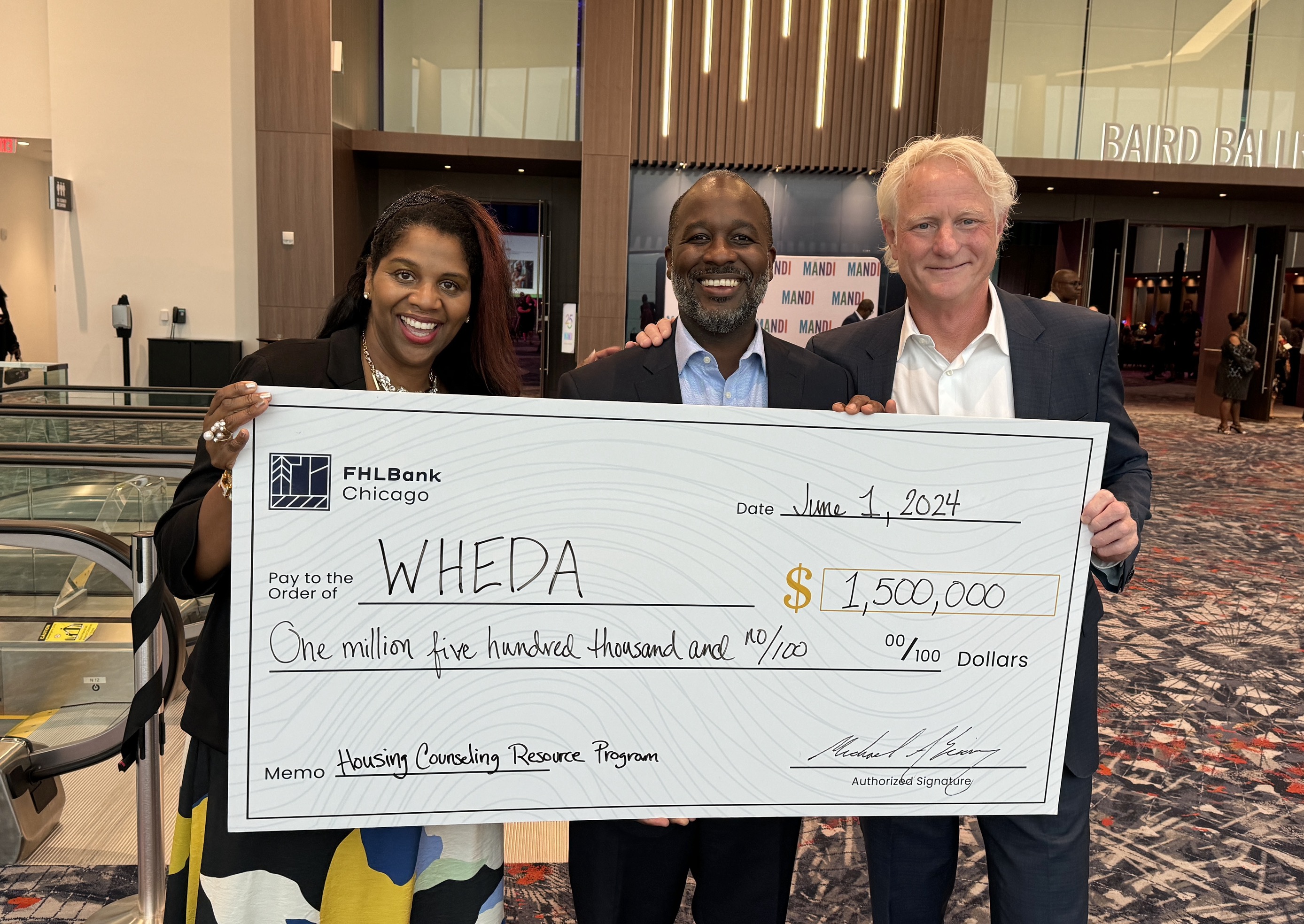

Shalonda Bedenfield-Causey, Lead Community Investment Operations Specialist at FHLBank Chicago (left), and Mark J. Eppli, Board Director at FHLBank Chicago (right), present a $1,500,000 check to Elmer Moore, Jr., Executive Director and CEO of WHEDA (center), for the Housing Counseling Resource Program.