FHLBank Chicago Announces Q2 2024 Financial Highlights

Increases commitment to over $180 million for affordable housing and community development for 2024

The Federal Home Loan Bank of Chicago (FHLBank Chicago) today announced its preliminary and unaudited financial results for the second quarter of 2024. As of the second quarter, FHLBank Chicago increased its commitment to over $180 million for affordable housing and community development initiatives for 2024.

“We had a strong second quarter in providing our member financial institutions with reliable liquidity and funding to support the housing finance and economic development needs of their customers and communities that is especially critical in a tight credit market,” said Michael Ericson, president and chief executive officer of FHLBank Chicago. “We also continue to leverage our financial strength to support our members reinvesting back in their communities. By increasing our contributions to our community investment programs for 2024 this will further expand our impact.”

Growing Commitment to Housing and Community Development

FHLBank Chicago has allocated $88 million toward its annual Affordable Housing Program (AHP), representing a 17% increase over 2023 allocations. AHP grants support affordable housing projects and developments and provide downpayment and closing cost assistance to income-eligible borrowers. $19 million was disbursed to nearly 2,000 homebuyers through the first half of 2024 in partnership with 180 member financial institutions.

Applications for the Community First® Accelerate Grants for Small Business opened June 3, making available $19.5 million to support up to 1,300 small businesses, a significant increase compared to more than $4 million awarded in 2023.

Additionally, FHLBank Chicago offers Community Development, Housing and Small Business Advances at below market rates to help members fund affordable housing and economic development needs in their communities. The Community Small Business Advance subsidy increased to $18 million in support of zero percent financing, an 80% increase over 2023 amounts. Nearly $1 billion was funded in Community Advances through the first half of 2024 to support housing for more than 4,000 individuals and families, and more than 3,500 jobs.

In further support for investing in communities, FHLBank Chicago announced a Community Impact Advance three-year pilot program to provide $50 million in subsidies to discount the rate on advances up to 200 basis points. The goal is to directly support increased housing supply, job creation and enhanced community development activity.

Second Quarter 2024 Financial Highlights

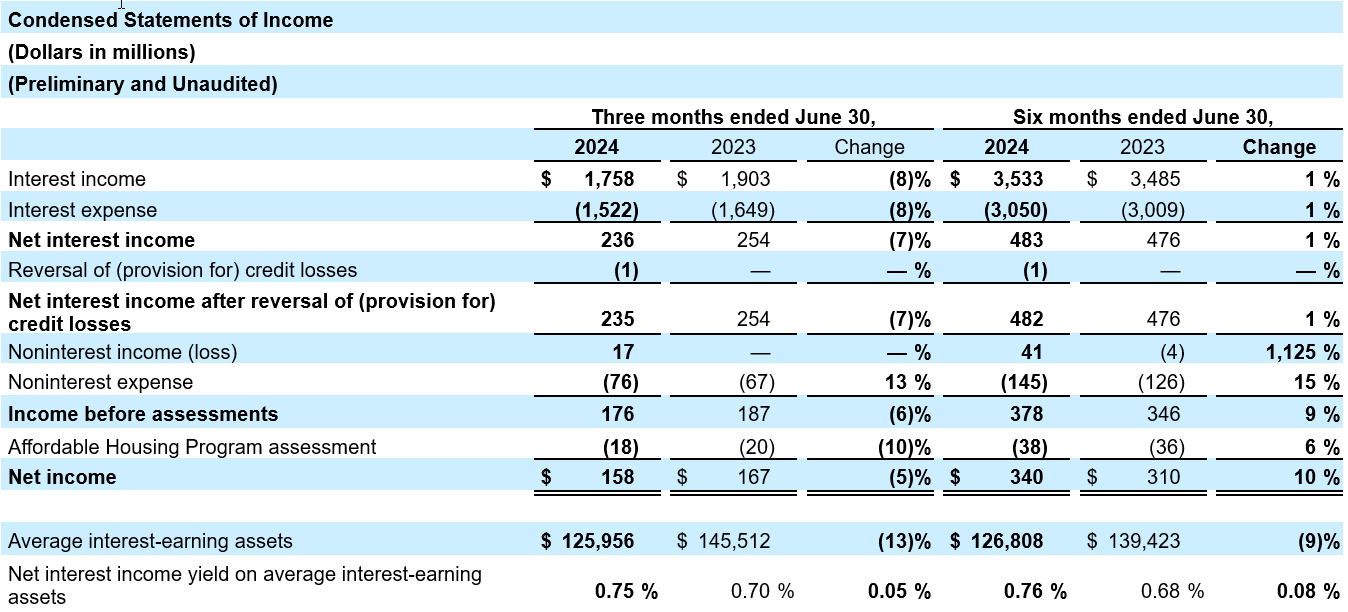

- Net income was $158 million, compared to $167 million for the second quarter of 2023, driven by decreased volume of advances in portfolio and an increase in noninterest expense which was primarily driven by increased contributions to housing and community development initiatives.

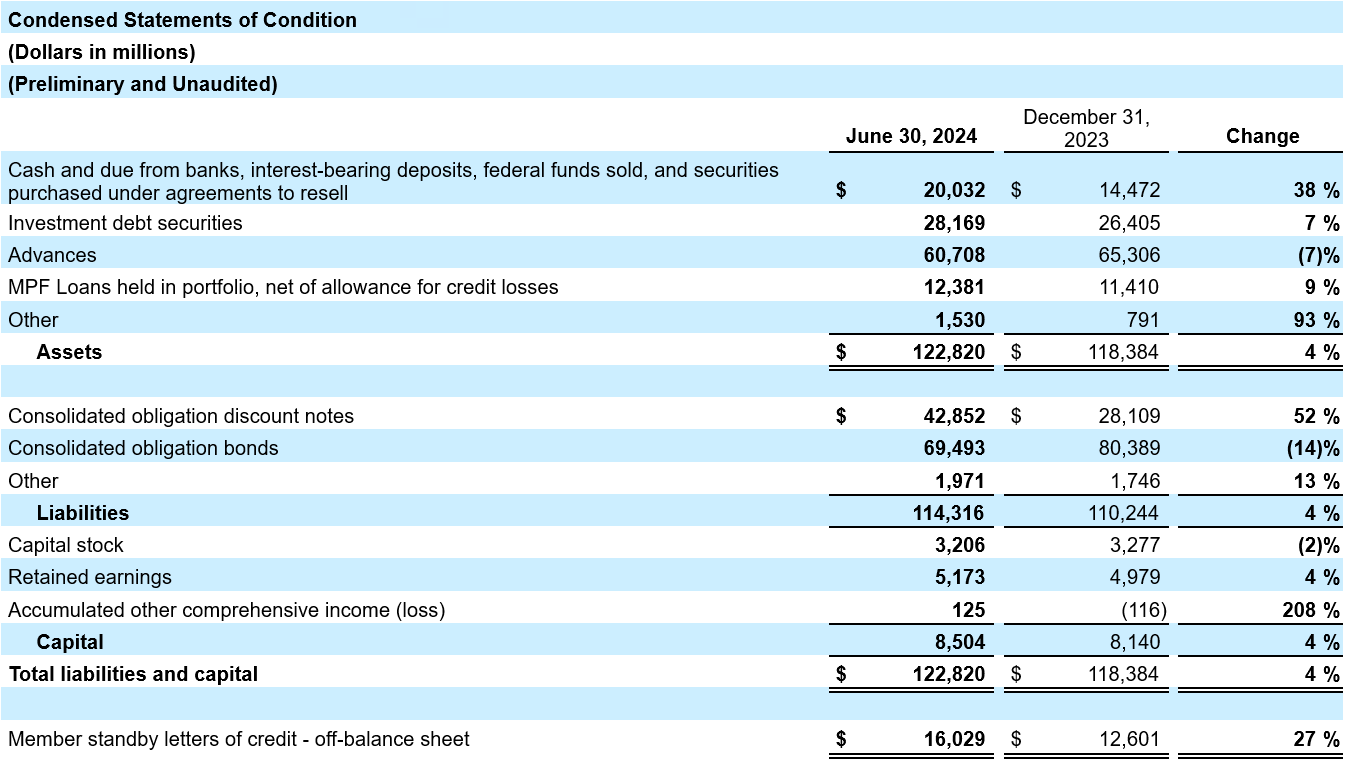

- Total assets increased to $122.8 billion, compared to $118.4 billion at December 31, 2023, with the change primarily attributable to an increase in our liquidity portfolio.

- Advances outstanding decreased to $60.7 billion, compared to $65.3 billion at December 31, 2023, primarily attributable to depository members experiencing less funding needs on their balance sheets along with reduced loan demand which resulted in paydowns.

- Mortgage loans held for portfolio through the Mortgage Partnership Finance® Program increased to $12.4 billion, compared to $11.4 billion at December 31, 2023, primarily attributable to new acquisition volume that outpaced paydown activity.

For more financial details, please refer to the Condensed Statements of Income and Statements of Condition below. The Form 10-Q for the quarter ending June 30, 2024, is expected to be filed with the Securities and Exchange Commission (SEC) next month.