Margin Changes for Certain Security Types at FHLBank Chicago

What Is Changing?

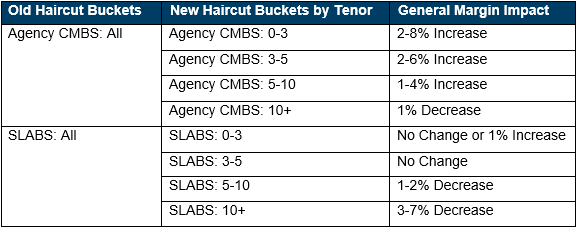

First, commercial mortgage backed securities guaranteed by Fannie Mae and Freddie Mac (Agency CMBS) and eligible student loan asset backed securities (SLABS) will be transitioning from a single margin for each asset type to separate margins based on the tenor of the pledged securities. An overview of the new buckets and the range of margin impacts is summarized below.

Second, margins for AAA-rated, non-agency, single asset single borrower (SASB) and single-family rental (SFR) commercial mortgage backed securities (CMBS) with original credit enhancement of 30% or more will decrease by five percentage points. Margins for all other non-agency CMBS types will remain unchanged.

How Do the Changes Affect Me?

If your institution currently pledges any of these security types, please contact your Sales Director for details on how your margins and CLV will change.

When Is the Change Effective?

These changes are effective April 1, 2021.

FHLBank Chicago remains committed to protecting the cooperative while also supporting the needs of our members. If you would like to increase your collateral position, please talk to your Sales Director about which strategies may be right for you.