FHLBank System Regulator Provides LIBOR Transition Guidance

As a continuation of our LIBOR transition guidance, we are providing an update on our FHLBank Chicago products with a LIBOR component. The original guidance sent to our members was on September 27, 2019.

What’s Changing:

What’s Changing:

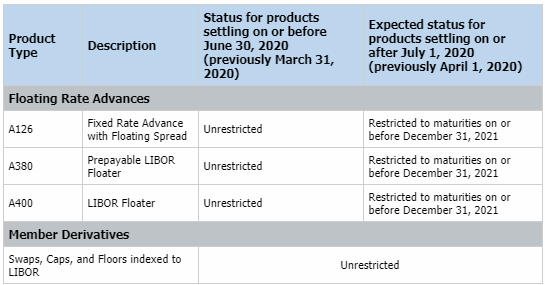

- Members may execute certain Floating Rate Advances referenced to LIBOR from now until June 30, 2020 (previously March 31, 2020), with no tenor restriction as long as the transactions settle by June 30, 2020. Beginning July 1, 2020, members can still transact certain Floating Rate Advances referenced to LIBOR as long as they mature by December 31, 2021.

- Member derivatives, such as caps and floors and vanilla LIBOR swaps for members that do not otherwise have access to derivative dealers, are unrestricted as to maturity.

What’s Not Changing:

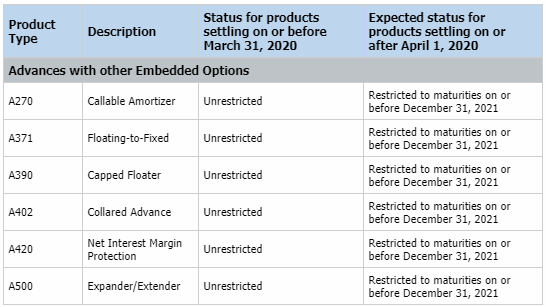

- Advances with Other Embedded Options with a LIBOR component listed below remain unchanged and members can transact from now until March 31, 2020, with no tenor restrictions as long as the transactions settle by March 31, 2020. Beginning April 1, 2020, members can still transact the below advance products with a LIBOR component as long as they mature by December 31, 2021.

- Upcoming collateral reporting changes due to the LIBOR transition were previously communicated on December 13, 2019, and remain unchanged.

As a reminder, if you are looking to replace these products, Discount Note-indexed floaters, Prime-indexed floaters, and SOFR-indexed floaters are good alternatives to LIBOR floaters and are not subject to these maturity restrictions. Visit our advances page for a complete list of our advance product offerings.

If you have questions regarding this communication or would like more details on the LIBOR transition, please contact your Sales Director.